Cannabis

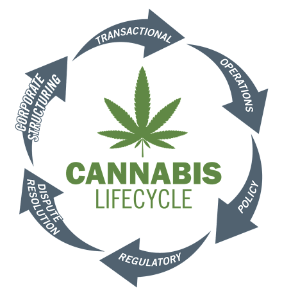

The multibillion dollar cannabis industry is rapidly growing both in the United States and globally. Our lawyers and policy professionals are accustomed to working with clients in heavily regulated industries and can help you achieve your business goals through the entire multidimensional cannabis lifecycle.

We are experienced in working with clients whose businesses live in a constantly changing regulatory environment—and there is no business where that environment is changing as quickly as the cannabis industry. It remains the only industry in the world that is both legal and illegal within the same nation. These constraints—and related risks for investors and clients, are changing almost on a daily basis. Our cross-disciplinary and cross-border teams are both adept and nimble enough to help you navigate these challenges and reach your business goals throughout the lifecycle of the cannabis business.

We are experienced in working with clients whose businesses live in a constantly changing regulatory environment—and there is no business where that environment is changing as quickly as the cannabis industry. It remains the only industry in the world that is both legal and illegal within the same nation. These constraints—and related risks for investors and clients, are changing almost on a daily basis. Our cross-disciplinary and cross-border teams are both adept and nimble enough to help you navigate these challenges and reach your business goals throughout the lifecycle of the cannabis business.

We stay abreast of evolving legislative developments to help investors and other clients navigate the complex web of federal, state, and local laws and regulations. Since restrictions remain in federal law and in the laws of some states in the United States and in the laws in other jurisdictions, we evaluate the objectives of each client to determine how we can best assist in achieving them, while identifying and mitigating risk. Our globally integrated team can provide a full range of services.

CORPORATE STRUCTURING

We have the special knowledge needed to represent cannabis related companies from initial organization and financing, to mergers and acquisitions, and sales transactions.

TRANSACTIONAL

We have a sophisticated Corporate practice that assists clients with a wide range of transactional matters including, capital equity financing, debt financing, domestic and cross-border financing, mergers and acquisitions, joint ventures and affiliations, and tax structuring. We also assist public companies with their filings with the Securities and Exchange Commission and other agencies.

OPERATIONS

We have the experience to counsel clients on operational issues including agricultural operations, land and equipment leasing, processing, supply chain, packaging, and distribution. We also provide real estate, construction, intellectual property, and labor and employment services.

POLICY

We work to shape the laws and regulations that affect our clients in the cannabis space. We are in the room and at the table when discussions are being held about developing laws and regulations, and we provide critical input as to the implications of those decisions. We also educate decision makers on the implications of their actions before they happen.

REGULATORY

Compliance with national, state, and local requirements applicable to the industry is essential. We assist clients on matters including permitting and licensing requirements, water rights, safety and health, labor and employment, environmental, tax, and antitrust among others.

DISPUTE RESOLUTION

Similar to other industries, those involved in the cannabis industry will face disputes—both business and governmental—that will require experienced hands to resolve and if necessary, litigate. We handle negotiations, mediations, and arbitrations, as well as litigation and contentious matters around the world.

Thought Leadership

The year 2025 saw significant regulatory activity in the realm of digital assets. The US Congress and financial regulators took steps to create and implement a clear legal framework to facilitate financial transactions using digital assets, and they will continue to do so in 2026.

On 20 February 2026, the US Supreme Court issued its decision in Learning Resources, Inc. v. Trump, consolidated with Trump v. V.O.S. Selections, Inc., addressing whether the President has authority under the International Emergency Economic Powers Act to impose tariffs.

In this article, Dr. Jan Boeing and Arnaud Dobelle outline the key milestones of the new regulatory framework, its interplay with financial sector rules such as DORA and PSD2, and what the upcoming Digital Omnibus proposal means for organisations deploying AI in Europe.

New York state and New York City continue to advance an extensive and evolving framework of workplace regulations.