Franchising Update - May 2018

We start by congratulating Chris Nikou on being named the Best Lawyers® 2018 Franchise Law "Lawyer of the Year" in Australia. Well deserved Chris!

We are expecting 2018 to continue to be busy in the franchising industry. In a release on 23 March 2018, the ACCC announced its priorities for 2018 including "a particular focus on Franchising Code of Conduct issues involving large or national franchisors".

In addition to being a focus for the ACCC, notice was given in the Senate of an inquiry into the Franchising Code and Oil Code on 21 March 2018. The Parliamentary Joint Committee on Corporations and Financial Services are due to report on the matter by 30 September 2018 (their terms of reference are set out later in the newsletter).

Quick links

This newsletter contains articles regarding:

- Parliamentary Inquiry into the Franchising Code and Oil Code

- the ACCC's focus on franchising in 2018

- a list of the fines/penalties under the Franchising Code since it was last amended

- disclosure obligations regarding former franchisees – ACCC issues a warning to franchisors regarding compliance

- changes to the law regarding directors of employers who fail to pay employee super

- marketing fund audit laws and tips

Parliamentary Inquiry into the Franchising Code and Oil Code

The Parliamentary Joint Committee on Corporations and Financial Services has been asked by the Senate to conduct an inquiry into the Franchising Code and Oil Code. They are due to report back to the Senate by 30 September 2018. The particular issues that they will consider are:

- the operation and effectiveness of the Franchise Code of Conduct, including the disclosure document and information statement, and the Oil Code of Conduct, in ensuring full disclosure to potential franchisees of all information necessary to make a fully-informed decision when assessing whether to enter a franchise agreement, including information on:

- likely financial performance of a franchise and worse-case scenarios

- the contractual rights and obligations of all parties, including termination rights and geographical exclusivity

- the leasing arrangements and any limitations of the franchisee’s ability to enforce tenants’ rights

- the expected running costs, including cost of goods required to be purchased through prescribed suppliers

- the effectiveness of dispute resolution under the Franchising Code of Conduct and the Oil Code of Conduct

- the impact of the Australian consumer law unfair contract provisions on new, renewed and terminated franchise agreements entered into since 12 November 2016, including whether changes to standard franchise agreements have resulted

- whether the provisions of other mandatory industry codes of conduct, such as the Oil Code, contain advantages or disadvantages relevant to franchising relationships in comparison with terms of the Franchising Code of Conduct

- the adequacy and operation of termination provisions in the Franchising Code of Conduct and the Oil Code of Conduct

- the imposition of restraints of trade on former franchisees following the termination of a franchise agreement

- the enforcement of breaches of the Franchising Code of Conduct and the Oil Code of Conduct and other applicable laws, such as the Competition and Consumer Act 2010, and franchisors

- any related matters.

We will keep you updated as to any legislative changes that arise from the inquiry.

Please contact Anna Trist, Special Counsel, of the Melbourne office with any queries.

The ACCC's focus for 2018

The ACCC announced that its priorities for 2018 (contained in its Compliance & Enforcement Policy) would focus on "franchising issues involving large or national franchisors" and in continuing to assist Australia's 2.2 million small businesses:

- "ensuring they continue to receive the protections of the unfair contract terms law and industry codes

- addressing consumer guarantee issues in new car retailing

- dealing with conduct that may contravene the misuse of market power provisions and concerted practice provisions."

On 27 March 2018, the ACCC released its "Small business 2017 snapshot" which includes key statistics highlighting its work in 2017. This work included:

- "receiving 8,721 contacts including nearly 5000 reports

- referring 2,627 reports and enquiries to state/territory Small Business Commissioners

- undertaking 7 enforcement actions and issuing $177,000 in penalties

- issuing 29 compliance checks for the franchising, horticulture, and food and grocery industry codes."

In the current climate, particularly given the increased scrutiny that franchisors face in the current inquiry and recent scandals and legislative changes, it is important that franchisors understand their legal obligations. K&L Gates can help by providing advice as to these legal obligations and introducing systems into your network that can assist with ensuring compliance with legal obligations (including the provision of training to relevant staff).

Please contact Chris Nikou, Partner, of the Melbourne office with any queries.

Fines against franchisors for breaches of the Franchising Code

The imposition of penalty provisions under the Franchising Code, which provisions came into effect on 1 January 2015, has changed the risk profile of franchising and made compliance a greater focus for franchisors.

The Franchising Code contains financial penalties for breaches of certain provisions of up to AUD63,000 (per breach per franchisee) and infringement notices (AUD10,500 for body corporates and AUD2,100 for individuals and other entities).

Examples of the application of these penalties and infringement notices being used in franchising are set out below.

|

Date / Franchisor |

Breach |

ACCC Comment |

|

November 2017 Fastway Couriers (Perth) AUD9,000 Infringement notice and Court enforceable undertaking. |

Infringement notice for regulation 9(1) of the Franchising Code The franchisor allegedly provided a disclosure document that did not include details of former franchisees that had terminated or transferred their courier franchises to a prospective franchisee. The franchisor provided an enforceable undertaking to address concerns raised by the ACCC that advertising an "income guarantee" of $1,500 per week for 30 weeks was a false or misleading representation regarding the future earnings of courier franchisees (instead the franchisor needed to provide actual earnings information and not describe the financial support it offered as an "income guarantee"). |

"The ACCC is sending a clear message that it will act to ensure prospective franchisees receive the information required by the Franchising Code so that they are able to make informed decisions about the purchase of a franchise." Action taken to "educate franchisors and send a strong message that all franchisors must comply with the [Franchising] Code." |

|

November 2017 Pastacup AUD150,000 (the franchisor Morild Pty Ltd paid $100,000 and the co-founder and former director paid $50,000 for being knowingly concerned in the breach) The franchisor consented to the penalties, declarations and injunctions by the Federal Court and to an order that it pay a contribution to the ACCC's costs. |

Failure to provide a disclosure document that complied with the Franchising Code. Failure to disclose that the co-founder/director had been a director of two previous franchisors of the Pastacup franchise system that each became insolvent. Failure to disclose relevant business experience in the disclosure document. |

"These significant penalties should send a strong message to other franchisors that they must meet their disclosure obligations." "The Franchising Code requires franchisors to provide prospective franchisees with a disclosure document which contains important information about the franchise and the franchisor. Full and accurate disclosure by the franchisor is essential to enable prospective franchisees to make informed business decisions." |

|

May 2017 Dominos AUD18,000 (Domino's paid penalties after the ACCC issued infringement notices) |

Infringement notice for regulation 15(1)(d)(i) and 15(1)(d)(ii) of the Franchising Code Failure to comply with the requirement in the Franchising Code to provide franchisees with both an annual marketing fund financial statement and an auditor's report within the time limits prescribed under the Franchising Code. |

"Marketing fund contributions are often a significant expense and franchisors need to provide timely and accurate disclosure of the fund's activities." "Ensuring small businesses receive the protection of industry codes is an enforcement priority for the ACCC." |

|

May 2017 Geowash Leave sought by the ACCC to take legal action and to seek penalties, compensation for franchisee and the disqualifications of the franchisor's director (amongst other remedies) |

The ACCC allege that:

|

|

|

May 2017 Ultra Tune Proceedings commenced seeking a refund of the prospective franchisee's payment, declarations, injunctions, pecuniary penalties, compliance and adverse publicity orders. |

The ACCC allege that:

|

"Franchisors must act in good faith in dealings with prospective franchisees." "Franchising contributes significantly to the retail economy, and all franchisors must comply with the Code and be transparent in dealings with franchisees. Ensuring that small businesses receive the protections of industry codes is a current ACCC compliance and enforcement policy." |

|

April 2016 SensaSlim Declarations and orders of the Federal Court including disqualification orders |

The franchisor engaged in false representations, misleading and deceptive conduct by failing to disclose the director's involvement in the SensaSlim franchise in its disclosure document. |

"People who decide to buy into a franchise system typically put much of their own savings on the line, and they must be able to make informed business decisions on the basis of full and accurate disclosures by the franchisor." |

|

December 2015 Electrodry AUD215,000 and declaration ordered by consent in the Federal Court |

The franchisor was alleged to have used false testimonials (engaging is false representations and misleading and deceptive conduct). |

|

|

March 2015 Coverall Melbourne AUD500,000 penalty ordered by Federal Court |

The franchisor engaged in unconscionable conduct, false or misleading representations and breaches of the Franchising Code. |

The above penalties show the ACCC's willingness to impose penalties for contraventions of the Franchising Code. For some franchisors, it may alter the risk profile they have previously used when judging the consequences of non-compliance with the Franchising Code. A checklist of the relevant provisions that attract a penalty is available from our office on request.

Please contact Anna Trist, Special Counsel, of the Melbourne office with any queries.

Disclosure Obligations Regarding Former Franchisees – ACCC Issues a Warning to Franchisors Regarding Compliance

The ACCC recently took to email to reiterate the due diligence that should be conducted by potential franchisees looking to purchase a franchise. "We always recommend prospective franchisees speak to as many current and former franchisees as they can" the ACCC advised.

The Franchising Code requires that franchisors provide contact details of certain former franchisees in their disclosure document. This obligation is intended to assist prospective franchisee by giving them access to information including:

- a franchises viability

- practical issues that could arise or have arisen in operating the franchised business

- assistance that the franchisor provides and has provided (of which franchise agreements often contain little practical detail)

- why franchisees have entered or left the franchise network.

The ACCC has stated that it is reasonable to expect that franchisors provide an email address and/or phone number for former franchisees (not just the former business address or business phone number, which details are likely to be useless once the franchisee is no longer operating the franchised business). The ACCC have urged that franchisors assist prospective franchisees with their due diligence by providing meaningful contact details of former franchisors and have stated that where these details are not provided the prospective franchisee should query why the information is not being disclosed.

Under the Franchising Code franchisors are not required to maintain contact information for former franchisees that is "up-to-date". But the ACCC has made it clear that the information that is maintained should be "reasonable". The contact information should enable a prospective franchisee to contact a former franchisee as part of the prospective franchisee's due diligence.

The Franchising Code does not require the disclosure of contact information where a former franchisee has requested in writing that the information not be disclosed. Previously, it was the practice of many franchisors to make this request of the franchisees on their exit from the network as a matter of course, however this has not been the case for some time. Since 1 July 2010 franchisors have not been permitted to influence the former franchisees to disclose their contact information upon such a request.

For further advice on the topic, please contact Anna Trist, Special Counsel, of the Melbourne office.

Changes to Obligations of Employers Regarding Superannuation

Unfortunately, it is not unusual for franchisors to be in the position of dealing with franchisees that have not complied with their obligations as employees in paying the superannuation due to their employees. The laws surrounding this issue are expected to change shortly.

On 28 March 2018 the Treasury Laws Amendment (2018 Measures No. 4) Bill 2018 was introduced. It contains significant proposed changes aimed at strengthening compliance with superannuation guarantee obligations by employers, including recalcitrant employers who intentionally and repeatedly disregard their obligations and continuously fail to pay their superannuation liabilities.

The proposed legislation empowers the Commissioner of Taxation to issue directions to employers to undertake specific actions in instances where the Commissioner is satisfied that there has been a failure to comply with an obligation or a failure to pay a charge under the Superannuation Guarantee (Administration) Act 1992 (SGAA). The key features are as follows:

- The Commissioner can issue a direction to an employer if the employer has failed to pay an amount of superannuation guarantee charge, or an estimate of superannuation guarantee charge, for a quarter.

- The employer must ensure that the amount of the unpaid liability is paid within the period specified in the direction.

- Failure to comply with the direction can result in criminal penalties (imprisonment for up to 12 months) and/or a maximum of 50 penalty units.

The Bill is significant as currently directors can be personally liable for unpaid superannuation guarantee obligations under the director penalty notice provisions. The proposed legislation extends a director's liability to include possible imprisonment.

It is proposed that the changes will have effect from 1 July 2018.

Note that the ATO has estimated that the superannuation gap, that is, the difference between the superannuation required to be paid and that is actually paid is in the order of AUD2.85 billion.

If you have any further questions on this issue, Rebecca Bolton, Special Counsel of our Melbourne office can be contacted to discuss the matter further.

Marketing Fund Obligations and Compliance Tips

Obligations

Under the Franchising Code, franchisors are required to:

- Keep the marketing fund income in a separate bank account from other money held by the franchisor.

- Only use the marketing fund to meet expenses that:

- Have been disclosed in the disclosure document

- Are legitimate marketing or advertising expenses

- Have been agreed to by a majority of franchisees

- Reflect the reasonable costs of administering and auditing the fund.

- The marketing fund financial statement must be prepared and audited within 4 months of the end of the financial year (e.g. by 31 October 2018). Copies of these documents must be provided to contributing franchisees within 30 days of their preparation (e.g. by no later than 30 November 2018).

- The marketing fund does not need to be audited for a particular financial year if 75% of franchisees who contribute to the fund vote against undertaking an audit (this vote must occur within 3 months of the end of relevant financial year e.g. by 30 September 2018 for the financial year ending 30 June 2018).

- The statement and audit report must be provided to franchisees. This means it could be handed out at a conference, posted in the mail, faxed or emailed to each franchisee. In our view making it available on the intranet, or emailing a link to the intranet does not meet the Code requirement of providing it to the franchisee.

- It is the franchisor's responsibility to provide the statement and audit report. A franchisee should not have to request the information before it is provided.

Financial Reports

The Code requires franchisors to prepare a financial statement outlining who contributes to the fund and what the money is spent on. The statement must include sufficient detail so as to give meaningful information about sources of income and items of expenditure, especially relating to marketing activities.

The Code doesn't define what "meaningful" information means. The ACCC have advised that they believe the statement to mean "having real impact; substantial" (which is the dictionary meaning of the term). The ACCC have urged franchisors to err on the side of caution in providing more information. The information provided must be truthful, clear and accurate. Franchisor's should take into account what a franchisee would reasonably expect to see.

The ACCC have previously stated that in their view, meaningful information about a marketing fund statement requires genuine transparency about:

- Sources of income (eg franchisees contributions, corporate club contributions, supplier rebates)

- The nature of the marketing or advertising services provided (eg merchandise, photography, brochures/flyers, website design, online search terms, third party graphic design, equipment rental, radio advertising, online directory listings, print advertising)

- $ amount for the relevant services (within reason)

- Geographical scope of the advertising or marketing, where relevant (eg local, state, national).

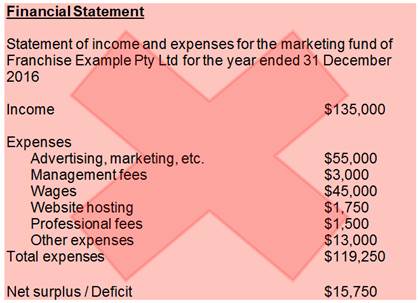

Below is an example published by the ACCC in September 2017 of a marketing fund statement that does not provide sufficient information or "meaningful information" and does not give franchisees enough detail to understand how the money was spent.

The ACCC have acknowledged that there are "no hard and fast rules" regarding what is "sufficient" in these circumstances (beyond the example of what is not sufficient set out above). A number of options were discussed with the ACCC at the Franchising Conference in October 2017. Options discussed included, adding footnotes to the financial report that referred to previous communications with franchisees regarding the marketing fund expenditure, attaching copy of a yearly marketing plan, attaching a schedule with further information and providing further information in the report itself.

Potential Consequences of Non-Compliance

If a franchisor fails to comply with the Franchising Code this could come to the attention of the ACCC in two main ways, namely:

- A franchisee could complain to the ACCC (they can do this anonymously)

- The franchisor's compliance could be randomly checked by the ACCC. Compliance with the marketing fund requirements is likely to come up in any random check of a particular franchise system.

The failure to comply with the marketing fund regulations can have significant consequences. If a regulation is breached with respect to the network the potential penalty is up to AUD54,000 multiplied by the number of franchisees in the network. This is potentially a very large amount. Despite this risk, the likely penalty would probably be much less. For example, in May 2017 Domino's Pizza paid penalties totalling AUD18,000 over its failure to provide franchisees with both an annual marketing fund financial statement and an auditor's report within the time limits prescribed by the Code.

For further advice on the topic, please contact Anna Trist, Special Counsel, of the Melbourne office.

This article was written by Anna Trist, Special Counsel, in the Melbourne office.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.