Milk, Batteries, Healthy Snacks, two Cartels and a Coffin: The ACCC Enforcement Shopping List

In Brief

The Chair of the Australian Competition and Consumer Commission (ACCC), Rod Sims, has announced the ACCC's 2020 compliance and enforcement priorities.

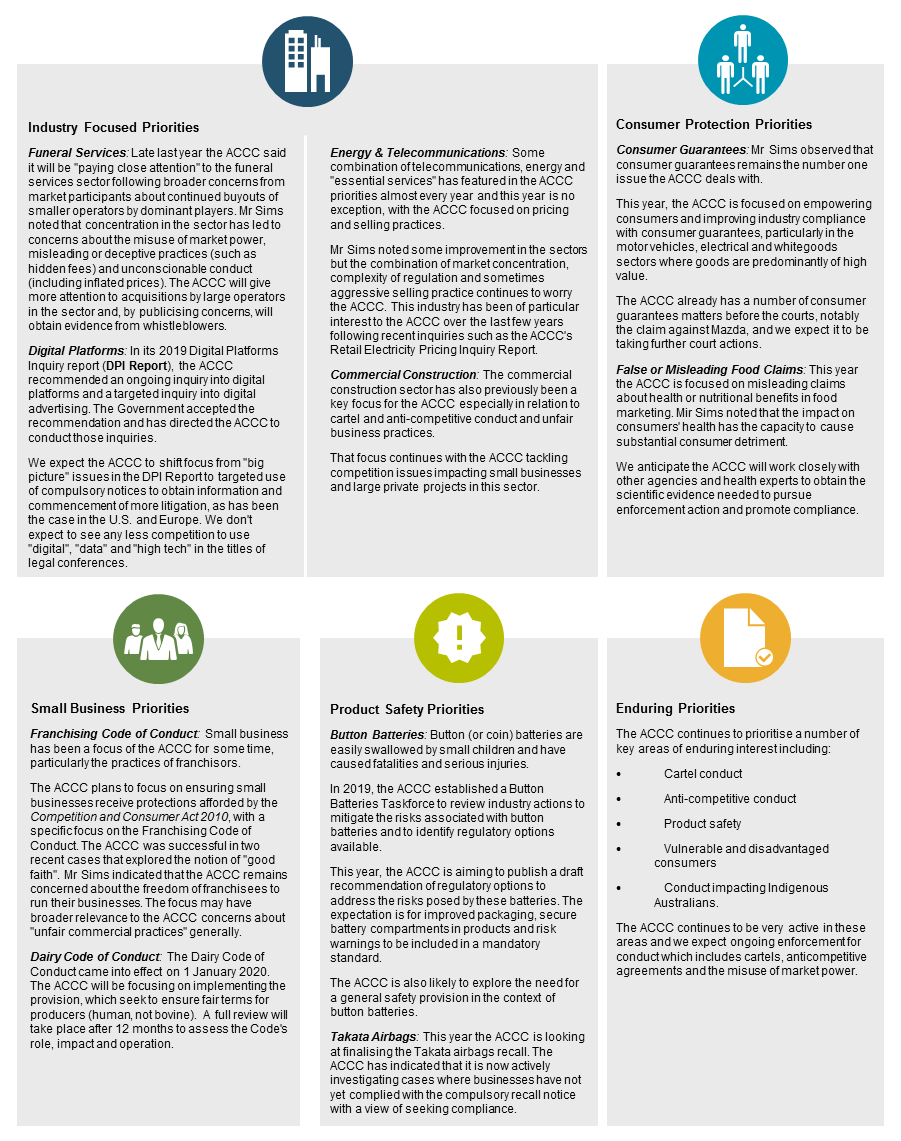

For the most part, the 2020 priorities reflect a continuation of themes from recent years: a focus on key competition threats (cartels and the misuse of market power), the digital economy, ensuring compliance with consumer guarantees and an ongoing project to address unfair trading practices, particularly as they affect small business.

However, there are a number of industry sectors not previously listed. The headline changes are:

- a focus on both competition and consumer problems in the funeral industry

- more enforcement around misleading food labelling

- increased attention to small business matters, particularly in franchising.

Mr Sims stressed that the ACCC will increase enforcement activity and said there are likely to be "at least two new cartel cases" and "at least four new competition cases" to be commenced this year. He also noted the large increase in the level of fines in some "standout" cases during 2019, particularly in consumer matters.

After several years of intense work on market studies, the announcement suggests some re-weighting of the ACCC's activities back to core enforcement functions.

The Full List of ACCC Priority Areas for 2020

- Funeral services

- Digital platforms

- Energy and telecommunications

- Food marketing

- Commercial construction

- Small business

- Dairy

- Consumer guarantees

- Product safety: button batteries and Takata airbags.

Takeaways

In recent speeches, including this one, Mr Sims has spoken at length of the tension that is sometimes evident in enforcing the Competition and Consumer Act 2010. He noted that the 2020 priorities were framed within the context of broader policy debates on the degree of concentration in the economy and "unfair trading practices".

Mr Sims stressed that the ACCC is "driven by a fundamental belief in markets. Under most circumstances, free and open markets work in favour of consumers and businesses of Australia." On the other hand, he observed "while the profit motive underpinning market behaviour is a key driver of economic wealth, the pursuit of profit does not always promote the interests of Australian consumers."

In resolving that tension, Mr Sims said the ACCC will exercise judgment based heavily on market evidence about when to intervene.

"…rather than risk chilling investment or innovation, our enforcement action is more likely to focus corporate behaviour on actions that benefit consumers rather than harming them."

In practice, the ACCC's approach to this tension suggests – not surprisingly – a continuation of its approach in recent years. The Australian regulator has been recognised internationally as a vigorous and effective enforcer of the competition laws. However, the ACCC's approach (and Mr Sims' comments in recent years) indicate it is unlikely to take cases based on the more expansive competition theories that have driven some litigation in Europe. The ACCC is equally active in enforcing the consumer laws.

The ACCC's "evidence-based" approach is to be welcomed but also raises the likelihood of participants in priority markets receiving compulsory notices to provide information or documents. The ACCC has also rapidly built its own capability to analyse data and market information and, on occasion, to use data experts in litigation. We expect to see more emphasis on that sort of evidence in the future.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.