The European Commission's New Foreign Subsidies Regime - How to Best Prepare and What to Expect

Businesses intending to undertake substantial mergers and acquisitions (M&A) transactions or participate in major public procurement projects in the European Union (EU) will soon need to prepare for an additional layer of scrutiny by the European Commission (Commission) under the Foreign Subsidies Regulation (FSR), with “foreign” in this context meaning non-EU. Assessing obligations and risks for businesses under the FSR, as well as collecting information early, can prevent delays in future EU M&A transactions and the award of a contract in EU public procurement procedures. Our alert sets out the FSR’s most important elements businesses should be aware of.

The rationale of the new FSR regime is to create a level playing field between EU and non-EU companies receiving state support, by filling a regulatory gap that is not otherwise covered by EU law, including rules on state aid, foreign investment screening, merger control and trade defence instruments. See our previous alert on the subject here.

The FSR, which entered into force on 12 January 2023, will apply from 12 July 2023, the date by which the Commission will be able to open ex officio investigations (defined below). The mandatory notification requirement will only take effect as of 12 October 2023.

The Commission has also published a draft implementing regulation, which will clarify the applicable procedures, including notably the actual notification forms to be used (Draft Implementing Regulation). The Draft Implementing Regulation is expected to be adopted before July of this year and it is only then that the exact scope of the disclosure requirements will be firmly established.

HOW CAN THE FSR AFFECT BUSINESSES?

Similar to competition rules, the FSR will create burdens and in some cases opportunities for businesses. The FSR will:

- Require that buyers of a company or a joint venture with significant EU sales, who have received state funding, submit a mandatory pre-closing filing to the Commission;

- Require such bidders in public procurement procedures of a certain size to notify the national contracting authority in the EU;

- Allow the Commission to investigate such a business even if it did not participate in notifiable transactions (ex officio investigations); and

- Provide the possibility for businesses to alert the Commission to financial contributions received by competitors, which distort competition (complaints).

Once the Commission receives a notification, it will determine whether the financial contributions received will distort competition in the EU internal market and, if so, decide whether to impose redressive measures to remedy the distortion or accept commitments offered by the notifying party. In a worst-case scenario, the Commission may block a transaction or the award of a contract in a public tender. A notified concentration cannot be completed and the award of the contract in a public procurement procedure cannot take place until the Commission has concluded its assessment.

HOW CAN BUSINESSES PREPARE?

The scope of financial contributions that the parties must disclose to the Commission is extremely broad and covers all contributions received from non-EU countries over a period of three years preceding the notification. For businesses planning to participate in a concentration or public procurement in the EU, the best way to prepare for the new rules is to start considering how best to establish an internal process to gather the information that the FSR requires, particularly in relation to foreign financial contributions. Such information will require a significant amount of time to collect, and for some third countries, it may be difficult to identify financial contributions. It is therefore advisable to start gathering information as early as possible.

Which Information Should Businesses Collect?

Businesses should collect information on the main elements and characteristics of the financial contributions (e.g., form and terms of the contribution, granting entity, purpose, and economic rationale for granting the contribution) and supporting evidence. In addition, businesses may wish to collect information on other elements the Commission examines to determine whether a financial contribution constitutes a distortive foreign subsidy within the meaning of the FSR (such as the financial contribution's impact on competition and on achieving general EU policy objectives).

The FSR defines “financial contribution” very broadly, including, among others, capital injections, grants, loans, fiscal incentives, and the provision or purchase of goods.1 This means that virtually any dealing with foreign public authorities and state-owned/state-controlled companies is to be reported. At the time of reporting, it is not for the notifying party to judge whether or not such dealings may constitute subsidies. Where businesses are part of a larger group, financial contributions to all members of the group should be included.

According to the Draft Implementing Regulation, the following documentation must be submitted with the notification:

- Analyses, reports, surveys, presentations, or comparable documents either from the grantor or recipient of the foreign financial contribution explaining the purpose and economic rationale of the foreign financial contribution, as well as possible positive effects of the foreign financial contribution;

- Specifically for M&A transactions, a link to the most recent annual accounts or reports of the participants in the M&A transaction; and

- Copies of all supporting documents relating to the financial contributions granted in the three years preceding the notification. This requirement is limited to financial contributions that are likely to constitute distortive subsidies based on the criteria set out in Article 5(1)(a)-(d) of the FSR.2

In practice, gathering this type of information for each financial contribution will be a very time consuming and burdensome exercise. Some companies active in sensitive sectors have also raised concerns that there might be national security restrictions that would prevent them from disclosing this information to the Commission, subject to criminal liabilities.

In addition, it is unclear at this stage what “all supporting documents” in the last category refers to, and the Commission does not specify the types of evidence to be submitted. This may include among other documents, agreements awarding and setting out conditions attached to foreign financial contributions or relevant legislation e.g., regarding export finance. As a general rule, businesses should be able to provide supporting documentation for the information provided in a notification.

Businesses should pay significant attention to ensure that they do not supply incorrect or misleading information, as the Commission can impose fines of up to 1% of the worldwide group turnover or periodic penalty payments of up to 5% of the average daily group turnover until the violation is rectified.

There is a possibility for waivers during the pre-notification contacts, provided that the notifying party provides “adequate reasons” as to why certain information is not reasonably available, and why the missing information is not necessary for the examination of the case. Ultimately, however, the Commission will have discretion whether to grant these waivers or not and there have been calls for more clear criteria for granting waivers.

WHAT MORE CAN BUSINESSES DO?

Besides gathering information in preparation for a possible notification or ex officio investigation, businesses can also use the information they have gathered to assess obligations, risks, and opportunities under the FSR together with their legal advisors, as set out below.

Determine Whether the Notification Thresholds Are Met

It is important to have at least a preliminary view on whether the business in question satisfies the FSR “financial contribution” thresholds, as failure to notify a notifiable concentration or bid in a public procurement procedure may result in a fine of up to 10% of the aggregate turnover of a company—at group level—in the preceding financial year. The Commission can also impose fines of up to 1% of the group turnover of companies that supply incorrect or misleading information.

Assessing whether a notification requirement is triggered and—even more importantly—preparing such a notification can result in significant delays to the closing of M&A deals and awards of public contracts, especially as many businesses as well as public contracting authorities may not yet be familiar with the procedures. Collecting information early and consulting with experts can therefore significantly help prepare businesses, which are planning to participate in a public tender or M&A transaction during the second half of 2023 or during 2024.

In the context of an M&A transaction, foreign financial contributions must be notified if:

- The target (in case of acquisitions), one of the merging parties (in case of genuine mergers), or a joint venture that is established in the EU (in case of joint ventures) has a group turnover of at least €500 million (turnover threshold) in the EU; and

- Combined aggregate financial contributions of more than €50 million from third countries were granted in the three years preceding the transaction (financial contribution threshold).

When participating in a public procurement procedure, foreign financial contributions must be notified if:

- The estimated value of the public contract is equal to or greater than €250 million (and in addition, in case procurement is divided into lots, the value of the lot(s) to which the bidder applies is equal to or greater than €125 million) (value threshold); and

- The economic operator (and, where applicable, its main subcontractors and suppliers involved in the same tender and known at the time of submission of the notification) was granted aggregate financial contributions in the three years prior to the procurement procedure equal to or greater than €4 million per third country (financial contribution threshold).

Legal advice will be necessary to correctly calculate the thresholds, identify whether notification is required (including identification of potential main subcontractors and suppliers) and, if so, whether a comprehensive notification is required or the Commission would accept a simplified notification. However, in practice, if the size of the deal or the public contract exceeds the relevant threshold, the financial contribution thresholds for both M&A and public procurement procedures are so low that most international companies engaged in M&A transactions or in public tenders that meet the turnover or value thresholds will very likely have to make a notification.

Assess the Likelihood of Ex Officio Investigations

Comprehensive information on any financial contributions received from third countries will also ensure businesses are prepared in case the Commission requests notification or carries out an ex officio investigation, as it is empowered to do under the FSR. While the Commission has not clearly defined what information businesses must provide in case of an ex officio investigation, businesses would be well prepared to defend themselves if they have a clear record of all the relevant information relative to dealings with non-EU states and state-owned or state-controlled companies.

Use the FSR to Tackle Unfair Competition by Collecting Information Regarding Competitors

There is no obligation to collect or share information regarding foreign financial contributions received by competitors. However, if a business has information suggesting that a competitor enjoys an unfair competitive advantage due to a foreign financial support of any sort, it may share this with the Commission, who can decide to investigate the matter and take redressive measures. Such informal complaints can already be submitted now, but they will only be investigated from 12 July 2023. Before the entry into effect of the FSR, EU procurement law regulations and statutes transposed into national laws only provided for a right of the public contracting authority to reject an abnormally low tender (and notification of the Commission), if the bidder who received state aid was unable to prove that the state aid in question was compatible with EU law. In case of bidders subsidised by third countries, these regulations did however not apply. Now this legal loophole is closed and bidders are protected from certain competing foreign subsidised tenders when participating in procurement procedures.

The other side of the coin is of course that businesses should also be conscious of the fact that their competitors in turn might file a complaint, and may therefore want to assess the potential effect of financial contributions received.

While there is no formal reference to interested third parties or complainants in the FSR or the Draft Implementing Regulation, the very existence of the ex officio tool means that the Commission will be open to informal complaints. This could very likely happen with regard to competitive markets where foreign subsidies might potentially distort competition, but no M&A transaction or a public procurement project has been notified under the FSR. So far, the Commission has not provided guidance on the scope or detail of the information required for a complaint. However, as information on foreign financial contributions received by competitors can be difficult to obtain, the detail and amount of such information required to make a (successful) complaint to the Commission is not expected to be nearly as detailed as is required in mandatory notifications. Given the Commission’s experience with complaints regarding competition law infringements and unlawful state-aid, it seems likely that a similar approach will be followed in case of complaints under the FSR.

THE FSR MECHANISM IN ACTION

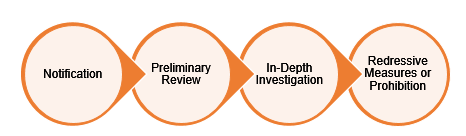

This section sets out the key stages of the FSR review by the Commission following notification. The same assessment procedure applies for ex officio investigations and when the Commission investigates a complaint.

Substantive Assessment

The first step in the Commission’s assessment is to consider whether the financial contributions notified by a party constitute foreign subsidies. A “foreign subsidy” in the context of the FSR means a financial contribution, which is provided directly or indirectly by a non-EU country, conferring a benefit (i.e., the fact that the company would not be able to obtain the contribution under normal market conditions), which is selective, i.e., limited to one or more companies or industries. The “benefit” criterion is largely inspired by EU state aid rules. The notion of “financial contribution”, however, is very broad as outlined above. Financial contributions to ailing businesses, export subsidies, or financial support enabling a business to submit an unduly advantageous tender are listed in the FSR as types of subsidies, which are most likely to be distortive.

As a second step, the Commission will determine whether the subsidy distorts the internal market. The concept of distortions of the internal market is already well-established both in the context of EU state aid and EU competition law. It can therefore be reasonably expected that the concept will be interpreted in line with the existing decisional practice in those fields. Nevertheless, the FSR in Article 5 identifies certain categories of foreign subsidies most likely to distort the internal market, including:

- Foreign subsidies granted to an ailing undertaking without a viable restructuring plan;

- Unlimited guarantees for debts or liabilities of the undertaking without any limitations on the amount or duration of such guarantee;

- Export financing measures not in line with the OECD arrangement on officially supported export credits;

- A foreign subsidy directly facilitating an M&A transaction; and

- A foreign subsidy enabling an undertaking to submit an unduly advantageous tender on the basis of which the undertaking could be awarded the relevant contract.

Finally, if the Commission finds that a foreign subsidy is distortive, it shall conduct a balancing test prior to deciding whether to impose redressive measures. The FSR only outlines general criteria for the balancing test. In essence, the Commission will balance the negative effects of a foreign subsidy, which could lead to a distortion in the internal market, against the positive effects of the subsidised activity, and the benefit to relevant policy objectives. The balancing test is a tool providing the Commission with flexibility in determining whether to accept commitments or impose redressive measures. It appears to be much broader than the consideration of efficiencies under merger control rules and is perhaps more similar to the “Union interest” test applied when considering trade defence measures.

The Commission is due to clarify the concepts of a distortion and the balancing test at the latest one year after the start of application of the FSR, i.e., by July 2024.

Possible Outcomes

The balancing test can lead to an unconditional clearance where the positive effects of the foreign subsidy outweigh its negative effects.

However, if the negative effects prevail, the Commission will be empowered to impose redressive measures or to accept commitments from the companies concerned in order to remedy the distortion. The balancing test can help determine the appropriate nature and level of the commitments or redressive measures.

Possible remedies (redressive measures or commitments) are modelled on the measures applied in merger control and state aid review procedures. They may entail reducing capacity or market presence (including by means of a temporary restriction on commercial activity); refraining from certain investments; requiring the companies to dissolve the concentration or parts thereof; or to offer access under fair, reasonable, and non-discriminatory (FRAND) conditions to infrastructure, production capabilities, or essential facilities that were acquired or supported by the foreign subsidies distorting the market.

Timelines

For concentrations, the FSR (just like the EU merger control regime) provides for 25 working days for a preliminary review by the Commission and 90 working days for an in-depth investigation. These time limits can be further extended in specific situations.

For public procurement, the Commission must complete the preliminary review within 20 working days, which can be extended by 10 working days in duly justified cases. An in-depth investigation must be completed within 110 working days, which can be exceptionally extended by 20 working days under special conditions.

KEY TAKEAWAYS

The FSR will require all businesses active in the EU to assess their potential exposure from their dealings with foreign states and public authorities. In particular, the FSR is relevant for businesses as follows:

- Businesses who may be involved in a concentration or public tender procedure in the next six months onwards should determine whether they are likely to trigger an FSR filing and incorporate this in their deal or procurement negotiations. Failure to notify could result in delays and, in the worst case, in the Commission blocking a transaction or the award of a public contract. It could also lead to a fine of up to 10% of the infringing parties’ worldwide group turnover in the last financial year.

- Businesses who may be involved in an EU M&A transaction or public tender procedure in the future, even when the notification thresholds are not met, or if they conclude the relevant transaction before the entry into effect of the new FSR obligation, should not neglect the possibility that the Commission may (based on its own initiative or following a complaint) request a notification or initiate an ex officio investigation. These businesses should set up internal teams tasked with identifying foreign financial contributions.

- Businesses suffering from competitors with an unfair advantage due to subsidies by a foreign state may also consider submitting a complaint to the Commission with the aim to trigger an FSR investigation of the subsidy. This would include, for instance, competitors who lost the opportunity to acquire a particular M&A target or lost a major procurement project in the EU.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.