The FAIR Act: Providing a Safe Harbor for ETF Research Reports

Background

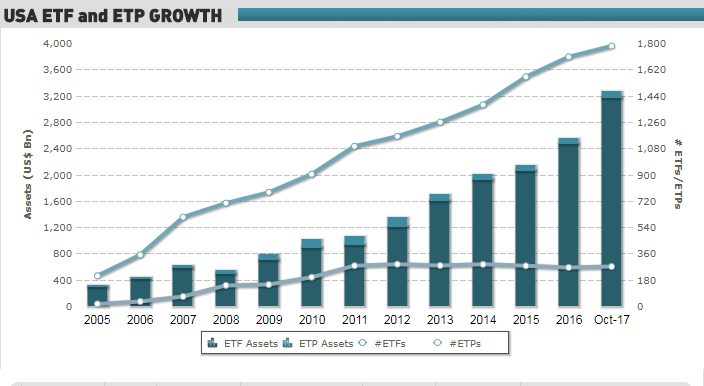

Investor demand for transparent, diversified, low-cost, passive investment products has accelerated over the last decade, and exchange-traded funds (“ETFs”) have been among the primary beneficiaries of this demand. Assets invested in exchange-traded products generally have grown significantly since ETFs first came to market in 1993.

ETFGI.com

With this growth in ETF assets under management, a parallel demand for expert analysis of ETFs has developed. Analyses of public issuers and their listed securities have historically been provided by professional analysts in the form of research reports, which have long been the subject of a series of safe harbors from the registration requirements of the Securities Act of 1933 (“Securities Act”). [1] One of these safe harbors, Rule 139, explicitly permits a broker-dealer that is distributing an issuer’s securities to publish a research report about those securities without the report itself being deemed a regulated offer to sell the covered securities under the Securities Act. The recent enactment of the Fair Access to Investment Research Act of 2017 (“FAIR Act”) will bring research reports covering ETFs on regulatory par with research reports on ordinary public equity and debt securities. The FAIR Act now requires the Securities and Exchange Commission (“SEC”) to expand the safe harbor for research reports under Securities Act, Rule 139, to cover so-called “covered investment fund” research reports, which would include ETF research reports.

Discussion

One of the cornerstones of the federal securities laws is the requirement that an offer of securities be accompanied by robust disclosure of matters material to the issuer and the securities being offered. This fundamental disclosure requirement is enforced by the anti-fraud provisions of the federal securities laws, as well as by detailed prospectus and registration statement requirements. For public offerings, disclosures about the issuer and its securities, including the prospectus, are contained in a registration statement that is filed with the SEC under the Securities Act.

Other provisions of the Securities Act require delivery of a prospectus and limit the types of communications, other than the prospectus, that potential investors in a registered offering may receive.

Notwithstanding the prospectus content and delivery requirements imposed by the Securities Act, certain rules, including Rule 139, have provided safe harbors to allow broker-dealers to publish research reports covering specified types of issuers and their securities without treating those reports as prospectuses. However, even though shares of ETFs trade in the secondary market just like traditional stocks, existing safe harbors have not covered research reports about ETFs or their shares. Rather, the safe harbors, including Rule 139, have only covered research reports on issuers that, among other things, register their securities either on Form S-3 or Form F-3 and that otherwise keep current on their periodic reports on Form 10-Q and Form 10-K. ETFs register their shares on Form N-1A and do not file periodic reports on Form 10-Q and Form 10-K. Therefore, a broker-dealer publishing and distributing a research report covering ETFs cannot take advantage of the safe harbors and would risk liability under the Securities Act with the publication of such reports.

Soon, however, the safe harbor of Rule 139 will be extended to ETFs, among others, given the President’s signing of the FAIR Act into law. [2] Under the FAIR Act, the SEC is expressly directed to expand Rule 139 to reach research reports of “covered investment funds,” such as ETFs. [3] As a result, broker-dealers will be permitted to publish research reports on ETFs — just as they do on other listed issuers.

The FAIR Act has its limits, however. The safe harbor created by it will not apply to (1) research reports that are published or distributed by (A) an ETF itself or its affiliates, (B) a broker-dealer that is also an investment adviser of the ETF, or (C) an “affiliated person” of an investment adviser of the ETF; or (2) certain research reports that cover business development companies or registered closed-end funds. In addition, of course, the FAIR Act will not limit the applicability of the anti-fraud or anti-manipulation provisions of the federal securities laws, as applied to research reports.

Interestingly, the FAIR Act adopts the definition of “affiliated person” that is set forth in the Investment Company Act of 1940 (the “1940 Act”). [4] Thus, a broker-dealer that is an affiliated person of an ETF or its adviser will not be able to rely on the safe harbor to publish and distribute research on the ETF. In addition, because the 1940 Act definition of “affiliated person” includes persons who own 5% or more of an ETF’s securities, the scope of broker-dealers permitted to rely on the new safe harbor may be more narrow than is immediately obvious and introduce unique compliance questions. This may be particularly true for ETFs during the seeding period, when a broker-dealer is likely to own more than 5% of their shares and, thus, be an affiliated person of the ETF.

Impact

The FAIR Act requires the SEC to adopt amendments to the current safe harbor within 270 days to expand it to so-called “covered investment fund research reports.” In addition, it provides for an interim safe harbor to become effective if the SEC does not meet this deadline. As a result, the FAIR Act’s safe harbor for research reports on ETFs will soon be effective, and research reports about ETFs will become increasingly important to ETFs, particularly new ETFs, seeking distribution among financial advisers, including independent financial advisers, who exercise investment discretion over a large swath of U.S. investors’ assets.

Notes

[1] These rules were codified nearly 50 years ago and have regulated the research process for regulated offerings. See, e.g., 17 C.F.R. § 230.137; 17 C.F.R. § 230.138; 17 C.F.R. § 230.139.

[2] The House passed its version of the FAIR Act (H.R. 910) by a bipartisan vote of 405-2 on May 1, 2017. Subsequently, the Senate passed by unanimous consent an amended version of the FAIR Act (S. 327). The House passed S. 327 by voice vote, and the President signed S. 327 into law on October 6, 2017.

[3] In addition, the FAIR Act explicitly instructs the SEC to restrict self-regulatory organizations, such as the Financial Industry Regulatory Authority (“FINRA”), from imposing or enforcing any rules on covered research reports that would prevent a broker-dealer from participating in a distribution of the securities that are also the subject of its research reports and restricts rule-making by the SEC that would condition reliance on the safe harbor with onerous conditions. However, under the FAIR Act, FINRA may continue to ensure compliance by members with the FINRA rules governing communications with the public, including with FINRA’s substantive rules on a member’s research activities.

[4] 15 U.S.C. § 80a-2(a). Under the 1940 Act, “affiliated person” of another person means:

(A) any person directly or indirectly owning, controlling, or holding with power to vote, 5 per centum or more of the outstanding voting securities of such other person; (B) any person 5 per centum or more of whose outstanding voting securities are directly or indirectly owned, controlled, or held with power to vote, by such other person; (C) any person directly or indirectly controlling, controlled by, or under common control with, such other person; (D) any officer, director, partner, copartner, or employee of such other person; (E) if such other person is an investment company, any investment adviser thereof or any member of an advisory board thereof; and (F) if such other person is an unincorporated investment company not having a board of directors, the depositor thereof.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.