The Return of Sequester-Level Budget Cuts

After two fiscal years of federal funding increases, sequester-level budget caps return next year, which will compel cuts of $90 billion in defense and non-defense programs. Lifting of the statutory budget caps will require enactment of a law with bipartisan support from the House and Senate, and President Trump’s signature. Such an effort to stave off significant funding cuts could be challenging, especially following last week’s election results that resulted in divided government. Accordingly, those who want to protect their favored federal program from cuts next year should start working to do so now.

Introduction

Federal Fiscal Year (FY) 2019 began on October 1, 2018 with much of the federal government (including military, veterans, healthcare, labor, education, energy, and water programs) fully funded through annual appropriations. Remaining federal programs are funded under a Continuing Resolution (CR) at FY-18 levels until December 7, 2018. Congress returned to session on November 13 after the bitterly-contested mid-term elections to pass appropriations for the remainder of FY-19 for those programs currently operating under the CR. Despite the uncertainty in completing the remaining FY-19 spending bills, this year’s appropriations process has worked better than recent years, which have been characterized by government shutdowns and long-term CRs.

However, that is likely to change next year. The budget caps, which were raised the past two fiscal years, slap back into place for FY-20. Unless the law is changed, sequester-level spending caps for defense and non-defense programs will return, with the threat of significant budget cuts. This brief policy insight explains how these caps, and the specter of sequestration, will affect most of the federal budget, and how you can prepare for it.

Historical Background and Next Year

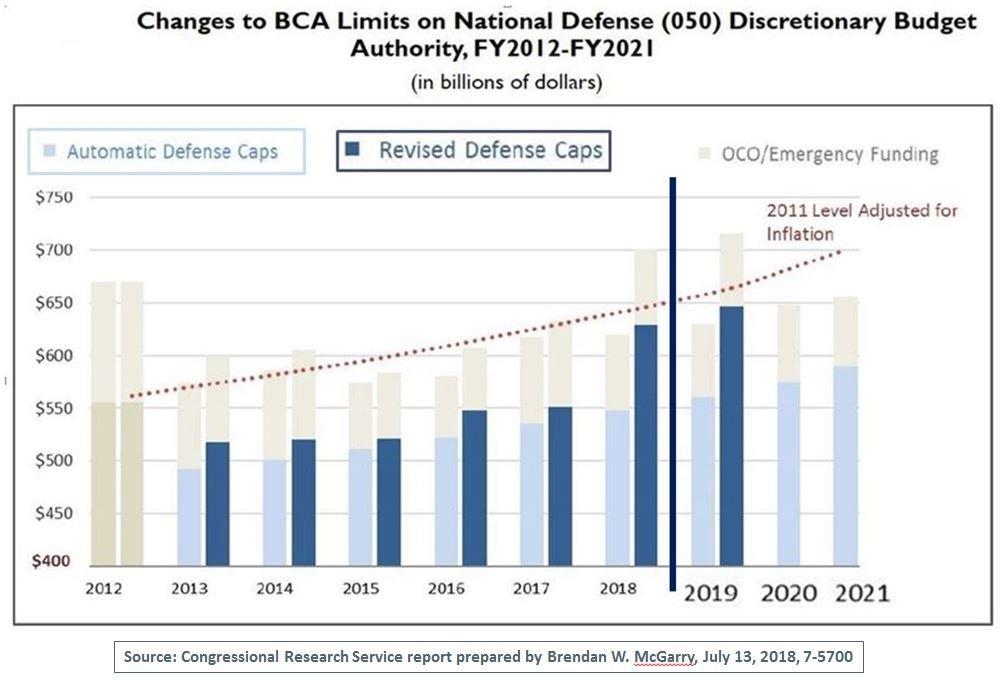

The Budget Control Act (BCA) of 2011 (P.L. 112-25) established budget caps on the amount of discretionary funding that Congress could annually appropriate through FY-21. Congress has raised the caps three times, most recently in the Bipartisan Budget Act of 2018 signed into law last February. This budget agreement increased the defense and non-defense caps by a combined amount of $143 billion for FY-18 and $152 billion for FY-19. The raising of these spending limits was the catalyst for Congress to complete the FY-18 appropriations with a massive bipartisan omnibus spending bill and for the relatively smooth sailing of the FY-19 appropriations process.

The new Congress convening in January may very well attempt to change the BCA again by raising the discretionary spending caps. However, the political dynamics following the mid-term elections appear to be even more polarized with Democrats retaking control of the House of Representatives and Republicans likely expanding their hold in the Senate. There is also renewed focus on the spiraling federal deficit, which is expected to approach $1 trillion in FY-19, and the overall national debt, which is nearing $22 trillion. Raising the caps will therefore require concerted bipartisan efforts to enact a public law (passage by both Houses of Congress and the President’s signature).

Unless BCA is changed, Congress will be forced to reduce federal spending to comply with the FY-20 budget caps, or across-the-board sequestration cuts will automatically kick in. Adherence to the budget caps will obviously mean less funding for numerous federal programs and tough decisions for Congress and the executive agencies as well as the White House Office of Management and Budget (OMB).

Return to Sequester Level Caps Means Significant Cuts

The cuts required to stay below the FY-20 spending caps will be painful. A recent Congressional Budget Office (CBO) report calculates that FY-20 topline budget will necessitate cuts of about $90 billion (or 7.4%) compared to the cap set in BCA for FY-19. CBO concludes that the cuts will fall disproportionately on defense: $54 billion of the $90 billion reduction will be allocated to defense discretionary spending (an 8.5% cut) and the remaining $36 billion will be allocated to non-defense discretionary spending (a 6% cut).

The net effect of these estimated cuts is actually more severe considering that the budget cap for FY-19 was raised above the original BCA limit. So, the actual appropriations of $1.244 trillion Congress is on track to approve for FY19 will require a net reduction of $126 billion (or a 10% cut) to stay within the budget cap that will be in effect for FY-20, assuming there is no change in law.

The magnitude of the spending cuts required just for defense programs is illustrated in a graphic below that was adapted from one prepared by the Congressional Research Service.

How to Prepare

Members of the House and Senate Appropriations Committees in the new Congress will determine where to find the required savings in defense and non-defense programs in order to comply with the lower FY-20 spending caps. The Trump Administration will also be looking for cuts as part of its FY-20 budget request, expected to be sent to Congress next February. In fact, the President has already directed most agencies to reduce spending by 5%, and OMB Director Mick Mulvaney has a well-deserved reputation as an aggressive budget cutter. Pretty much every discretionary federal program will be vulnerable to cuts as budget examiners at OMB and the appropriators in Congress struggle to stay within the FY-20 caps to avoid the draconian effects of sequestration.

After two years of spending increases, the FY-20 budget caps mean that, once again, Congress will operate in a tightly constrained fiscal environment. This will require supporters of federal programs to marshal their best arguments for prioritizing and defending these programs from budget cuts. To that end, anyone with a stake in federal discretionary spending should engage now to prepare and execute a strategic plan to protect their favored programs.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.