A Farewell to ANE: CFTC Proposes Rule to Improve Regulation of Cross-Border Swap Transactions

I. Introduction

The Commodity Futures Trading Commission (“CFTC” or “Commission”) recently approved a proposed rule (the “Proposed Rule”) to improve the regulation of cross-border swap transactions and establish a formal process for requesting comparability determinations for swaps compliance requirements. [1] Even though the Proposed Rule is directly applicable only to swap dealers (each an “SD”), asset managers will also be impacted by the new requirements and, if adopted, will need to comply with those requirements in order to continue to operate in the global derivatives markets. Notably, the Proposed Rule eliminates the “arranged, negotiated, or executed” standard (“ANE”) as a relevant factor for determining CFTC jurisdiction. The Proposed Rule was published in the Federal Register on January 8, 2020, and comments are due by March 9, 2020. [2]

The Proposed Rule has four primary components:

- The identification of cross-border swaps or swap positions a person would need to consider when determining whether it needs to register with the CFTC as an SD or a major swap participant (an “MSP”); [3]

- A revised substituted compliance process for certain regulations applicable to registered SDs;

- The elimination of ANE [4] as a relevant factor for determining whether the CFTC has jurisdiction over a particular transaction; and

- A mandate for SDs to create records evidencing their compliance with the Proposed Rule.

Practical Implications

- With the elimination of ANE as a relevant factor for determining jurisdiction over a swap transaction, SDs may use U.S.-based personnel to arrange, negotiate, and execute swaps on behalf of non-U.S. domiciled affiliates. [5] As a result, market participants, including asset managers, will have greater latitude to interact with U.S.-based sales and operational coverage at SDs without necessarily subjecting the swap to CFTC oversight.

- This is a marked departure from the previous approach whereby a person outside of the United States who engaged in swap transactions with other non-U.S. Persons would have been subject to the jurisdiction of the CFTC if they did so with the assistance of personnel in the United States who “arranged, negotiated, or executed” the transaction. The CFTC had previously asserted a “strong supervisory interest” to regulate swaps “between a non-U.S. SD and a non-U.S. person booked in a non-U.S. branch of the non-U.S. SD” if the non-U.S. SD used personnel in the United States. [6]

- Some persons currently registered as SDs may no longer have swaps exposure that requires them to register with the CFTC. As a result, such persons would no longer be subject to the CFTC’s registration scheme, meaning the risk management and business conduct standards would no longer apply to them.

- This could create a larger pool of SDs willing to transact with asset managers and their collective investment vehicles (each a “CIV”) deemed to be “U.S. Persons,” and the additional competition could create pricing and ancillary benefits for such asset managers. Alternatively, in select circumstances, a person may be required to register for the first time as a SD and thus would need to adopt the appropriate policies and procedures to abide by the CFTC’s regulations for registered SDs.

- Importantly, the Proposed Rule does not alter the definition of a “U.S. Person” for registrants other than SDs and therefore nearly all CIVs will not be directly impacted by the revised definition. As a result, the Proposed Rule potentially could create different definitions of the term “U.S. Person” that are applicable to different categories of registrants. The CFTC did provide some advance notice of the approach it might take if it were to harmonize the definition to apply to other registrants such as CPOs and CTAs by noting that: “determining the principal place of business of a CIV, such as an investment fund or commodity pool, may require consideration of additional factors beyond those applicable to operating companies.” [7] The Commission is of the view that with respect to an externally managed CIV, this location is the office from which the manager of the vehicle primarily directs, controls, and coordinates the investment activities of the vehicle. In the case of a CIV, the senior personnel that direct, control, and coordinate a CIV’s activities are generally not the named directors or officers of the CIV, but rather persons employed by the CIV’s manager or promoter, or in the case of a commodity pool, its commodity pool operator.

- Therefore, consistent with the SEC’s requirements, when a manager is responsible for directing, controlling, and coordinating the overall activity of a CIV, the CIV's principal place of business under the Proposed Rule would be the location from which the manager carries out those responsibilities. As a result, for purposes of complying with the CFTC’s Cross-Border Margin Rules, [8] it is expected that most asset managers’ margining practices will be unaffected by the Proposed Rule.

- In addition, the Proposed Rule’s definition of U.S. Person is consistent with the definition adopted by the SEC. [9] As a result, whether a person is a U.S. Person will generally be consistent under both the SEC and CFTC’s rules.

- A formalized process for requesting comparability determinations may allow some persons to be exempt from the Proposed Rule.

- If adopted as proposed, SDs will need to amend their compliance policies and procedures to account for the new requirements, and, in particular, ensure their recordkeeping procedures reflect the requirements of the Proposed Rule.

- The Proposed Rule notes that “The Commission intends to separately address the cross-border application of the Title VII requirements addressed in the Guidance that are not discussed in this release (e.g., capital adequacy, clearing and swap processing, mandatory trade execution, swap data repository reporting, large trader reporting, and real-time public reporting). With respect to capital adequacy requirements for SDs and MSPs, the Commission notes that it has proposed but not yet adopted final regulations.” [10]

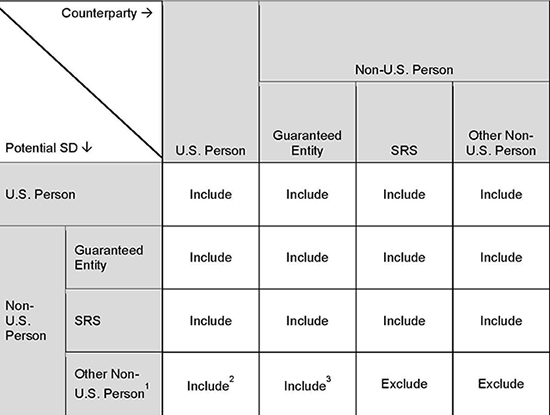

II. Cross-Border Swap Dealings to be Considered

For ease of reference this Alert contains an Appendix A, which provides charts summarizing this Section II.

Swap Dealer Registration

The CEA defines “swap dealer,” [11] and sets the de minimis threshold at US$8 billion notional amount, except for endowments and other “special entities.” [12]

In the Proposed Rule, the CFTC specifies that:

- A U.S. Person is required to include all of its swap dealing transactions in its de minimis threshold calculation without exception;

- A non-U.S. Person that is guaranteed by a U.S. Person (a “Guaranteed Entity”) or a Significant Risk Subsidiary (“SRS”) is required to include all of its swap dealing transactions in its de minimis threshold calculation; and

- A non-U.S. Person that is neither a Guaranteed Entity nor an SRS is required to include swap dealing transactions with a U.S. Person or a Guaranteed Entity in its de minimis threshold calculation, except for swaps conducted through a foreign branch of a registered SD.

III. Exceptions and Substituted Compliance

If a person is required to register as an SD, then such a person is subject to CFTC requirements regarding risk management and business conducts with respect to all of the person’s swap activities. In the Proposed Rule, the CFTC classifies certain of its regulations into Group A, Group B, and Group C for purposes of determining the availability of certain exceptions and substituted compliance with respect to each group of regulations.

- Group A: Includes requirements on (1) the chief compliance officer; (2) risk management; (3) swap data recordkeeping; and (4) antitrust considerations.

- Group B: Includes requirements on (1) swap trading relationship documentation; (2) portfolio reconciliation and compression; (3) trade confirmation; and (4) daily trading records.

- Group C: Includes external business conduct rules, which establish certain additional business conduct standards governing the conduct of SDs in dealing with their swap counterparties.

Exceptions

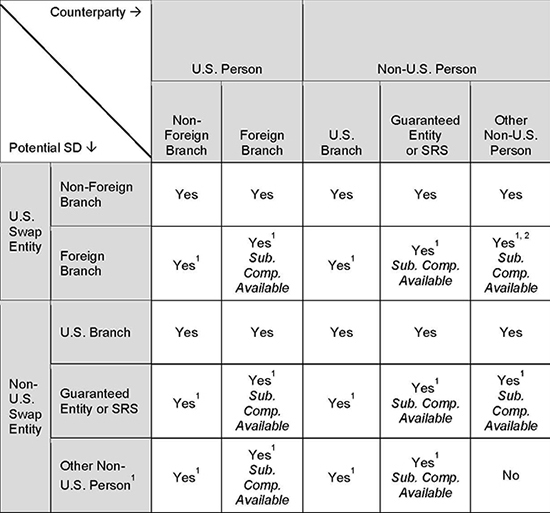

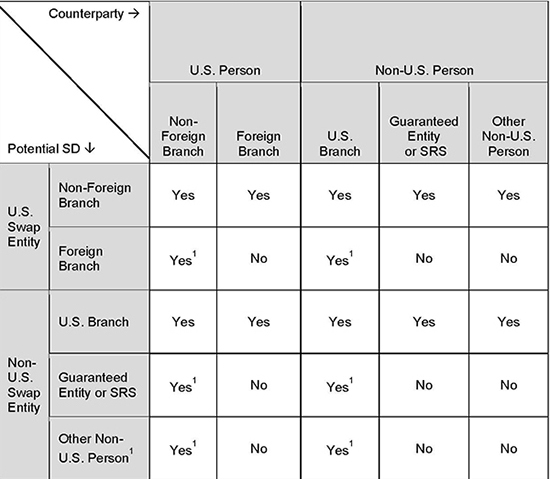

The CFTC proposed four exceptions from certain regulations for foreign-based swaps. Please see Appendix B for a charts describing the exceptions noted in this Section III.A.

1. An exception from certain Group B and Group C requirements for certain anonymous, exchange-traded, and cleared foreign-based swaps (the “Exchange-Traded Exception”);

- With respect to its foreign-based swaps that satisfy the Exchange-Traded Exception, each non-U.S. Person and foreign branch of a U.S. Person would be excepted from the Group B requirements (other than the daily trading records requirements); and

- With respect to any exchange-traded or cleared swap that is executed anonymously via a designated contract market, a registered swap execution facility, or foreign board of trade registered with the CFTC, each non-U.S. Person and foreign branch of a U.S. Person would be excepted from the Group C requirements. [13]

2. An exception from the Group C requirements for certain foreign-based swaps with foreign counterparties;

- With respect to its foreign-based swaps with a foreign counterparty, each non-U.S. Person and foreign branch of a U.S. Person would be excepted from the Group C requirements.

3. An exception from the Group B requirements for the foreign-based swaps of certain non-U.S. Persons with certain foreign counterparties; and

- With respect to any foreign-based swap with a foreign counterparty that is also a Non-U.S. Person, each non-U.S. Person that is a Non-U.S. Person would be excepted from the Group B requirements.

4. An exception from the Group B requirements for certain foreign-based swaps of foreign branches of U.S. Persons with certain foreign counterparties, subject to certain limitations, including a quarterly cap on the amount of such swaps (the “Foreign Branch Group B Exception”).

- With respect to any foreign-based swap with a foreign counterparty that is an Non-U.S. Person, each foreign branch of a U.S. Person would be excepted from the Group B requirements, subject to: (1) the exception would not be available with respect to any Group B requirement for which substituted compliance is available for the relevant swap; and (2) in any calendar quarter, the aggregate gross notional amount of swaps conducted by a person in reliance on the exception may not exceed five percent of the aggregate gross notional amount of all its swaps in that calendar quarter.

Substituted Compliance Process: A Holistic, Outcomes-Based Approach

In light of the interconnectedness of the global swap markets that suggests international comity, the CFTC proposes a substituted compliance regime, permitting non-U.S. Persons to avail themselves of substituted compliance with respect to the Group A and Group B requirements where the non-U.S. Persons are subject to comparable regulations in their respective home jurisdictions.

To determine the comparability of the regulations in non-U.S. Persons’ home jurisdictions, the CFTC proposes to implement a process, pursuant to which the CFTC would determine whether a foreign jurisdiction’s regulatory standards are comparable for Group A and Group B requirement purposes. The process would establish a standard of review that emphasizes a holistic, outcomes-based approach. [14]

Persons requesting comparability determination would be required to furnish to the CFTC: (1) information that provides a comprehensive understanding of the foreign jurisdiction’s relevant swap standards, including how they might differ from the corresponding requirements in the CEA and CFTC regulations; and (2) an explanation as to how any such differences may nonetheless achieve comparable outcomes to the CFTC’s attendant regulatory requirements. [15]

IV. Transactions Arranged, Negotiated, or Executed in the United States

Citing comment letters and guidance from the U.S. Treasury Department, [16] the CFTC no longer believes that looking to where a swap is “arranged, negotiated or executed” should be a relevant factor for determining jurisdiction under the Proposed Rule, with the notable exception of applying its anti-fraud provisions. It is anticipated that this change will allow U.S.-based personnel of non-U.S. SD or non-U.S. subsidiaries of U.S. SD to provide greater support when trading with non-U.S. Persons. All foreign-based swaps entered into between two non-U.S. Persons would be treated the same regardless of whether the swap is an arranged, negotiated, or executed in the United States. By eliminating ANE as a relevant factor for determining jurisdiction, buy-side participants can anticipate a more streamlined process for determining whether the CFTC has jurisdiction over a swap transaction.

V. Recordkeeping

The Proposed Rule imposes a mandate on SDs to create and retain records of their compliance with the Proposed Rule. Given that SDs are already subject to robust recordkeeping requirements, the CFTC estimates that, if the Proposed Rule is adopted, SDs would only incur minor incremental costs in modifying their existing systems, policies, and procedures.

VI. Looking Ahead

Regulation of the cross-border derivatives markets will continue to be an area of focus for the CFTC as it contends with how to best regulate derivatives in a global marketplace to promote liquidity, permit deference, and avoid market fragmentation. According to Chairman Tarbert, market participants can expect CFTC action in the near future on a number of key derivatives issues including: the swap dealer capital rule, position limits, enforcement penalty guidance, swap data reporting, bankruptcy rules, and guidance on digital assets. [17] K&L Gates’ global futures and derivatives team stands ready to assist market participants in the navigation of these developments, the evolving CFTC global derivatives regulatory agenda, and recent changes and proposed changes to the SEC’s regulation of derivatives and similar instruments.

Appendix A: Swap Dealer Registration Thresholds

View the full chart on page 8 of the linked PDF.

Appendix B

Exemption for Certain Group B Requirements

View the full chart on page 9 of the linked PDF.

Exemption for Certain Group C Requirements

View the full chart on page 10 of the linked PDF.

Notes

[1] CFTC Release Number 8097-19, CFTC Approves One Final Rule and Two Proposed Rules at December 18 Open Meeting, (Dec. 18, 2019), https://www.cftc.gov/PressRoom/PressReleases/8097-19. As a result of changes to the global regulation of swaps since the passage of the Dodd–Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the CFTC believes now is the appropriate time to revisit and update previously issued cross-border rules and guidance. The Proposed Rule is designed to limit opportunities for regulatory arbitrage by applying the registration thresholds in a consistent manner to differing organizational structures that serve similar economic functions or have similar economic effects. The Proposed Rule would supersede the CFTC’s prior views with respect to how its interpretations Section 2(i) of the Commodity Exchange Act (the “CEA”) and is intended to show deference to non-U.S. regulations when such regulation achieves comparable outcomes.

[2] CFTC, Cross-Border Application of the Registration Thresholds and Certain Requirements Applicable to Swap Dealers and Major Swap Participants, 85 FR 952, (Jan. 8, 2020), https://www.federalregister.gov/documents/2020/01/08/2019-28075/cross-border-application-of-the-registration-thresholds-and-certain-requirements-applicable-to-swap.

[3] While the Proposed Rule addresses both SDs and MSPs, it is important to note that there are no MSPs currently registered with the CFTC. Accordingly, this alert only address the Proposed Rules impact on SDs and counterparties of SDs.

[4] If adopted as proposed, the Proposed Rule would reduce the cross-border reach of the CFTC’s rules. This retreat is consistent with prior remarks made by CFTC Chairman Heath P. Tarbert and addresses criticism by market participants regarding the scope of the CFTC’s cross border rules. See press Release, CFTC, Joint Statement of the CFTC and the European Commission Following Meeting on Cross-Border Derivatives Regulatory Issues (Sept. 13, 2019), https://www.cftc.gov/PressRoom/PressReleases/8009-19.

[5] Nevertheless, the Securities and Exchange Commission (the “SEC”) recently adopted a package of rule amendments and guidance requiring non-U.S. Persons to count security-based swap dealing transactions against the thresholds associated with the de minimis exception to the “security-based swap dealer” definition if U.S. personnel arrange, negotiate, or execute those transactions. Such an approach directly contrasts with the CFTC’s reasoning in the proposing release.

[6] CFTC Staff Advisory No. 13-69, Division of Swap Dealer and Intermediary Oversight Advisory: Applicability of Transaction-Level Requirements to Activity in the United States, (Nov. 14, 2013), https://www.cftc.gov/sites/default/files/idc/groups/public/@lrlettergeneral/documents/letter/13-69.pdf.

[7] See footnote #2 at 960.

[8] See CFTC, Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants-Cross-Border Application of the Margin Requirements, 85 FR 952, (May 31, 2016), https://www.federalregister.gov/documents/2016/05/31/2016-12612/margin-requirements-for-uncleared-swaps-for-swap-dealers-and-major-swap-participants-cross-border.

[9] See SEC, Application of “Security-Based Swap Dealer” and “Major Security-Based Swap Participant” Definitions to Cross-Border Security-Based Swap Activities, 79 FR 47277 (09/08/2014), https://www.federalregister.gov/documents/2014/08/12/R1-2014-15337/application-of-security-based-swap-dealer-and-major-security-based-swap-participant-definitions-to.

[10] See 85 FR at n. 254.

[11] In general, the term “SD” means any person who (i) holds itself out as a dealer in swaps; (ii) makes a market in swaps; (iii) regularly enters into swaps with counterparties as an ordinary course of business for its own account; or (iv) engages in any activity causing the person to be commonly known in the trade as a dealer or market maker in swaps, provided however, in no event shall an insured depository institution be considered to be a swap dealer to the extent it offers to enter into a swap with a customer in connection with originating a loan with that customer. The term “swap dealer” does not include a person that enters into swaps for such person’s own account, either individually or in a fiduciary capacity, but not as a part of a regular business.

[12] A special entity is: “1) a Federal agency; 2) a State, State agency, city, county, municipality, or other political subdivision of a State, or any instrumentality, department, or a corporation of or established by a State or political subdivision of a State; 3) any employee benefit plan subject to Title I of the Employee Retirement Income Security Act of 1974 (ERISA) (29 U.S.C. 1002); 4) any governmental plan, as defined in Section 3 of ERISA; 5) any endowment, including an endowment that is an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986; or 6) any employee benefit plan defined in Section 3 of ERISA, not otherwise defined as a Special Entity, that elects to be a Special Entity by notifying an SD of its election prior to entering into a swap with the particular SD.” See CFTC, Q & A – Business Conduct Standards for Swap Dealers and Major Swap Participants with Counterparties Final Rulemaking, https://www.cftc.gov/sites/default/files/idc/groups/public/@newsroom/documents/file/bcs_qa_final.pdf.

[13] See footnote #2.

[14] Pursuant to the proposed eligibility requirement, three types of entities could request comparability determination: (1) swap entities that are eligible for substituted compliance; (2) trade associations whose members are such swap entities; or (3) foreign regulatory authorities that have direct supervisory authority over such swap entities and are responsible for administering the relevant swap standards in the foreign jurisdiction.

[15] See footnote #2.

[16] See U.S. Department of Treasury, A Financial System That Creates Economic Opportunities: Capital Markets, at 133-36 (Oct. 2017), available at https://www.treasury.gov/press-center/press-releases/Documents/A-Financial-System-Capital-Markets-FINAL-FINAL.pdf.

[17] Politico, Tarbert Lays Out Agenda, (Oct. 31, 2019), https://www.politico.com/newsletters/morning-money/2019/10/31/spooky-numbers-inside-gdp-781933.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.