ASIC Trialling Fast-Tracked Initial Public Offerings

On 10 June 2025, the Australian Securities and Investment Commission (ASIC) announced that it was commencing a two-year trial of a fast-tracked initial public offering (IPO) process (Fast-Track Process).

This announcement comes in response to the decline in IPOs and public companies in Australia.1

Who is Eligible for the Fast-Track Process?

To be eligible for the Fast-Track Process, entities planning an IPO will be required to have:

- A minimum projected market capitalisation at quotation of at least AU$100 million; and

- No securities that will be subject to escrow imposed by the Australian Securities Exchange (ASX),

(Eligible Entities or Eligible Entity).

What is the Fast-Track Process?

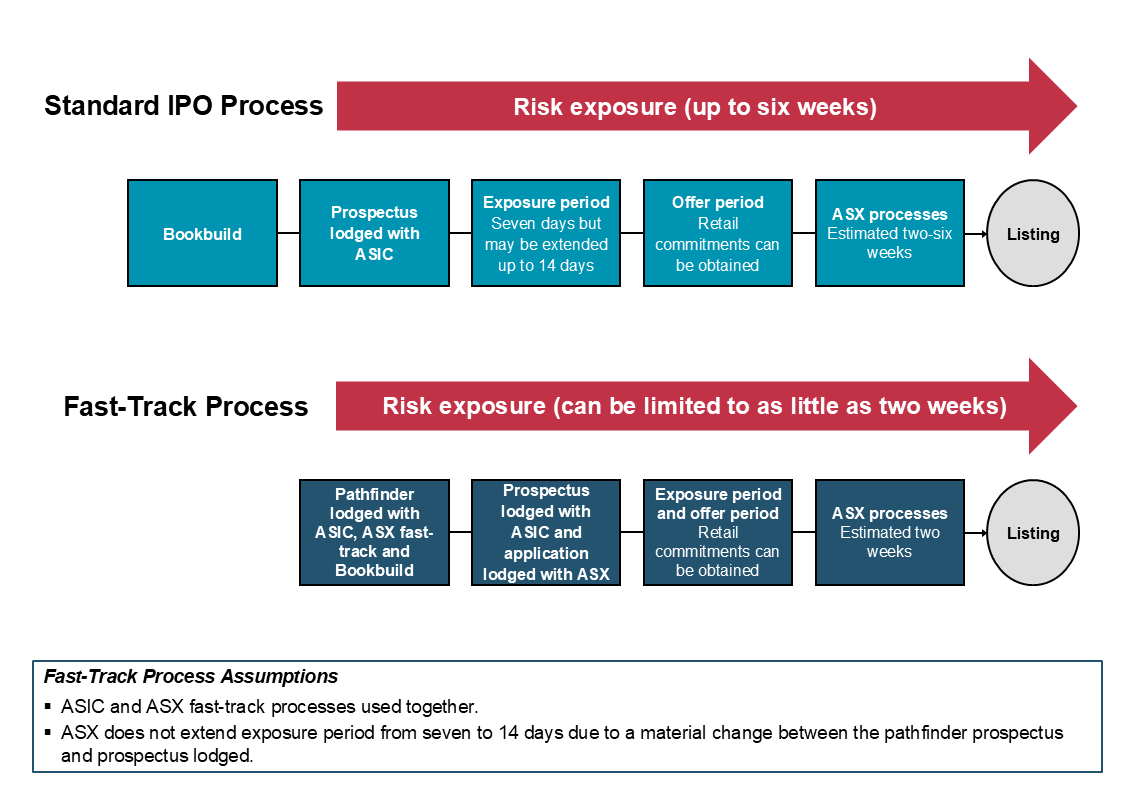

Under a standard IPO process, once a prospectus is lodged with ASIC for review, the prospectus is subject to a mandatory exposure period of seven days which is often extended to 14 days. Applications for securities offered under the prospectus can only be accepted after the exposure period ends.

Under the Fast-Track Process, Eligible Entities can provide a pathfinder prospectus (being a prospectus that is provided to institutional investors and omits pricing information) to ASIC at least 14 days prior to formal lodgement.2 As ASIC will be provided with an opportunity to review the pathfinder prospectus prior to lodgement, it will generally not need to extend the seven day exposure period after formal lodgement of the IPO prospectus.

However, if any new material information has been included in the prospectus or has come to light since the pathfinder prospectus was lodged with ASIC, the seven-day exposure period may still be extended. Accordingly, the prospectus lodged should not differ in any material respect from the pathfinder prospectus except for pricing, offer metrics and financial information, and as otherwise agreed with ASIC.

ASIC has also announced a "no-action" position meaning that ASIC does not intend on taking action where Eligible Entities accept an application for securities during the exposure period (which would be in contravention of subsections 727(3) or (6) of the Corporations Act 2001 (Cth)).3

Alignment with ASX Fast-Track Process

The Fast-Track Process aligns with the ASX's changes to Guidance Note 1 which took effect from 30 May 2025.

Under a standard IPO process, ASX will not commence review of a listing application until an entity lodges its prospectus with ASIC. Therefore, it may take up to six weeks from formal lodgement before a listing decision is made.

Under the revised Guidance Note 1, ASX may agree to "front end" its review where an Eligible Entity lodges a draft listing application (and accompanying draft documents) with the ASX no less than four weeks prior to the formal lodgement date of the prospectus with ASX (in the same form as lodged with ASIC).4 ASX estimates that official quotation of the Eligible Entity's securities would occur two weeks after formal lodgement of the prospectus with the ASX.

Eligible Entities are encouraged to discuss the Fast-Track Process with ASX at the earliest opportunity to ensure that ASX is agreeable and that its proposed timetable can be accommodated. We recommend raising the Fast-Track Process as part of any in-principle advice application lodged with the ASX prior to formal lodgement of the prospectus. ASX may reject the Fast-Track Process where the pathfinder prospectus and other documents are not near final drafts.

What are the Benefits of the Fast-Track Process?

The Fast-Track Process allows Eligible Entities to become listed on ASX faster.

As the Fast-Track Process provides ASIC with an opportunity to informally review a pathfinder prospectus before it becomes publicly available, ASIC may be able to raise concerns earlier in the process, thereby potentially reducing the need for replacement or supplementary prospectuses.

Additionally, the Fast-Track Process reduces the period between the pre-commitment of institutional investors to acquire shares in the IPO and the commencement of trading of the Eligible Entity's securities on ASX.

Accordingly, the Fast-Track Process should reduce the period during which institutional investors are "on risk" by decreasing the time that they are exposed to adverse market fluctuations while ASIC and ASX review the Eligible Entity's prospectus and listing application.

As the share price offered to institutional investors is often discounted to accommodate for risk, the reduction in time between institutional investor pre-commitment and quotation may lead to better pricing outcomes for Eligible Entities.

Risk Exposure of Institutional Investors Under a Standard IPO Compared to a Fast-Track Process

Source: Aimee Foster, K&L Gates, 2025

Conclusion

The Fast-Track Process trial is indicative of ASIC's attitude towards streamlining the process to encourage IPO activity. However, whether there will be an increase in the number of Australian IPOs over the next two years is yet to be seen.

As the Fast-Track Process trial may be ended at any time, we will update you further as required. If you have any queries or would like to discuss further, please do not hesitate to contact us.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.