Are the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) Schemes Still Relevant in 2018?

With the success of the Shanghai-Hong Kong Stock Connect (“Shanghai Connect”) and Shenzhen-Hong Kong Stock Connect (“Shenzhen Connect”) (together, the “Stock Connects”) and the Bond Connect (together with the Stock Connects, the “Connects”) and the soon-to-be-launched ETF Connect and the ease with which it has enabled non-People’s Republic of China (“PRC”) investors to access the PRC onshore securities market, the more than decade-old Qualified Foreign Institutional Investor (“QFII”) scheme and its younger sister, the Renminbi (“RMB”) Qualified Foreign Institutional Investor (“RQFII”) scheme, appear to be anachronistic remnants of a much less-sophisticated PRC securities market. Yet, with two announcements this year — one removing restrictions on the QFII scheme and the other expanding the investment scope for both the QFII and the RQFII schemes — the PRC regulators underlined that there are still opportunities for investors in these schemes.

The QFII and RQFII schemes are two of only five currently available methods for non-PRC investors to invest and trade in onshore securities in the PRC currently, the others being the Shanghai Connect, Shenzhen Connect, the Bond Connect, and the People’s Bank of China (“PBOC”) China Interbank Bond Market direct access scheme (“PBOC Scheme”).

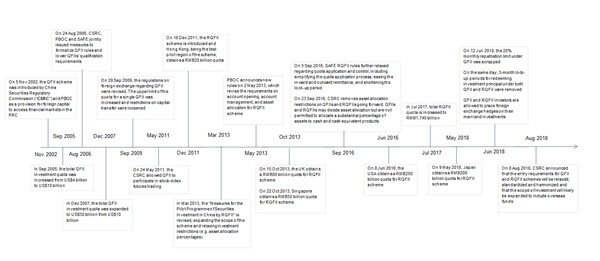

Timeline of Key QFII and RQFII Developments

Despite the fact that the QFII scheme was launched first in 2002 (almost a decade before the RQFII scheme), the QFII (as compared to the RQFII) scheme was generally viewed as a more restrictive scheme and, therefore, more suited to sovereign wealth funds or long-term horizon institutional investors. This was due, in no small part, to the less restrictive eligibility requirements for the RQFII scheme and the various amendments made to the RQFII scheme since its launch in 2011 as to, among other things, easing the restrictions on repatriation of proceeds and lock-up of funds, which made the RQFII scheme particularly suitable to open-ended funds.

There has long been agreement, however, that the PRC regulators should bring the QFII scheme closer in alignment with the RQFII scheme, and this was, fortunately, confirmed on June 12, 2018, when the PRC regulators announced a raft of amendments to the QFII scheme, chief of which were the removal of the monthly 20% cap on the repatriation of funds under the QFII scheme and the lock-up period for investment principal. In effect, this means that funds may now be fully-repatriated out of the PRC without the need to maintain a minimum amount within the PRC, and any investment principal remitted to the PRC for funding PRC onshore investments is no longer required to be retained in the PRC for any period of time.

More importantly, for investors who may have held back previously as a result of concerns about the liquidity of offshore RMB, the PRC regulators also indicated that they would permit QFIIs to hedge their currency risk onshore, utilizing onshore RMB to which they had previously not had any access.

Further, the CSRC announced on August 8, 2018 (the “Announcement”) that the entry requirements for QFII and RQFII schemes will be “relaxed, standardized and harmonized.” More interesting was the brief statement of their intention to “expand the scope of investment in overseas funds,” which could be interpreted to mean that QFIIs and RQFIIs may now invest in PRC private securities funds managed by non-PRC managers’ wholly foreign-owned entities (“WFOE”) in the PRC. If true, it would enable QFIIs and RQFIIs to invest directly into their “own” WFOE-managed PRC funds in the same way that listed companies repurchase their own listed shares in weak markets to support the entity. It is believed that this particular change of mindset came about as a result of extensive lobbying by foreign funds, as many have found it challenging to sell their WFOE fund products onshore in the PRC to PRC investors due to the tight-knit and competitive distribution market in the PRC.

Schemes: Compare and Contrast

Prior to the introduction of the Stock Connects, when only the QFII and RQFII schemes existed, which investment scheme to choose was a straightforward decision based, firstly, on whether or not you were an institutional investor and secondly, on whether or not you had available offshore RMB. However, the introduction of the Shanghai Connect in 2014 and the Shenzhen Connect in 2016 changed all of this, suddenly enabling foreign retail investors eligible to trade on The Stock Exchange of Hong Kong Limited (“SEHK”) (essentially any non-PRC investor over the age of 18) to access the PRC securities market through the “familiar” environment of the SEHK. There was no need to deal with specialized service providers, such as custodians, to ensure sufficiency of offshore RMB or to come to grips with an unfamiliar new PRC legal and regulatory environment. Subsequently, taking into account investors’ interest in accessing the PRC bond market, the PBOC Scheme was launched in 2016 and the Bond Connect in 2017. Together, this meant that if you wanted to invest in shares as a foreign retail investor, you could go for the Stock Connects, and if you wanted bonds, you could go for the Bond Connect. With these developments, the other schemes appeared to have become frosting on the cake, and unnecessary frosting at that.

However, as an investor under the Connects, you are just one in the mass of SEHK retail investors to whom a daily overall stock quota applies as a whole, something that may be difficult to manage. In the event that the maximum limit is reached, no further trading is permitted although, admittedly, in practice, this has, so far, only happened once to SEHK investors involved in northbound trading.

In contrast, a QFII or RQFII is treated, in all other respects, the same as a direct onshore PRC investor (save and except for the foreign shareholding restrictions which apply to all foreign investors) and subject only to your own individual quota granted by the PRC regulators in respect of the amount of securities that it can invest in on any given trading day rather than to the overall daily quota granted to all participants in the Stock Connects.

The Connects aside, on a more long-term basis, a PRC direct investor would certainly have more sway over and access to the PRC regulators than a nameless indirect investor trading through a central depository as in the case of the Connects. As history has demonstrated, the PRC regulators are very sensitive and responsive to issues affecting the market and many of the revisions to the existing direct investment schemes came about as a result of frequent consultations with market participants, such as their clarification on the capital gains tax issues. It is widely believed that the Announcement was a direct result of, among other things, the long-term lobbying by The Hong Kong Investment Funds Association (which represents many RQFII fund managers) to enable QFIIs and RQFIIs to be allowed to invest in PRC onshore private funds managed by non-PRC fund managers’ WFOEs.

The ultimate appeal of the QFII and RQFII schemes, however, especially as PRC bonds have been delivering encouraging returns recently, is the fact that the QFII and RQFII schemes have a far wider scope than the Connects, permitting investment in both PRC securities and PRC bonds, unlike the Stock Connects that only permit investment in limited PRC securities or the PBOC Scheme which only permits direct investment in certain PRC bonds. Realistically, then, the only schemes that allow maximum scope to invest directly in both PRC shares and bonds are the RQFII and the QFII.

Even though a specific timeline for launch of the measures under the Announcement was not provided, many industry observers believe the Announcement helps to distinguish the RQFII and QFII schemes further from the other direct access schemes, especially as this extends their investment scope well beyond what is now offered by the Connects (which had, to some extent, cannibalized the PRC direct investment market). And with the rise in Exchange-Traded Funds (“ETFs”) and the impending launch of the ETF Connect later in 2018, there is a double, perhaps even triple opportunity for an asset manager to take advantage of the PRC direct investment schemes — by being an RQFII holder, launching an ETF that utilizes its RQFII quota, listing that ETF on SEHK, and then accessing PRC and Hong Kong investors through the ETF Connect.

Which scheme is right for you?

If you are new to the PRC securities market and/or simply want to have some, but not substantial, exposure to popular PRC A-shares (and not bonds) without any long-term commitment (for example, your fund has a global strategy rather than a strictly narrow PRC focus), then certainly, the Stock Connects would work for you since there is minimal set-up or planning required — so long as you are able to open an account to trade on SEHK, you may begin trading immediately subject to the overall Hong Kong market quota. Or if your focus was solely on bonds and not equity, you might find the PBOC Scheme much more useful since the scope of the PBOC Scheme is wider than the scope of QFII/RQFII regarding bonds only. However, a more aggressive PRC-focused investor with a higher risk appetite who is keen to be directly exposed to onshore PRC assets on a long-term basis would find the QFII and RQFII schemes much more suitable with their own quota for individual QFII and RQFII license holders, capital mobility, and wider investment scope. And if you are both, there is nothing to stop you from being a QFII holder or an RQFII holder (and not just in one RQFII jurisdiction, but in several), as well as an investor through the Connects.

Bearing in mind that:

- the Connects are “indirect” investment schemes, which require investment restricted by the overall market quota available for the limited securities that are part of these schemes on SEHK and Hong Kong Securities Clearing Company Limited as its nominee to hold those securities; and

- the PBOC Scheme only applies to PRC onshore bonds;

the RQFII and the QFII schemes are, realistically, the only means for a foreign party to invest directly in onshore PRC securities.

Conclusion

Investors keen on directly investing onshore in the PRC must consider their strategy carefully and work on the basis of co-existence of the various direct access schemes, not exclusivity. Assuming that you already meet the required basics of wanting exposure to the PRC securities market, the choice of scheme depends on your investor-type and, of course, what you want to do with the investment rights.

More interestingly, even if you are not interested in investing in the PRC onshore equity or bond market, the expanded investment scope of RQFII and QFII schemes to PRC WFOE-managed funds means you may be able to build traction in respect of those WFOE-managed funds that may then lead to opportunities with PRC investors and, if successful, may persuade PRC regulators to eventually enable such WFOEs to provide investment advisory and discretionary investment services to QFII and RQFII license holders.

A review of the timeline of how Beijing made its announcements in respect of the various direct access schemes suggests that China has taken a deliberate approach to ensure a network of hubs within Asia and Europe that can continue to coexist and prosper along with the currency’s spread. The latest move is widely-interpreted as the CSRC taking positive steps to keep the QFII and RQFII schemes relevant in the light of the Connects and PBOC schemes and demonstrates that they still have a purpose for the QFII and the RQFII schemes, fixing them as needed along the way rather than discarding them entirely.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.