Domestic Content Guidance Offers Much Needed Answers but Also Raises Uncertainty About Qualification Requirements

Introduction

On 12 May 2023, the US Department of the Treasury (Treasury) and the Internal Revenue Service (IRS) released guidance for the domestic content bonus credit under Sections 45, 45Y, 48, and 48E of the Internal Revenue Code (Code). The Inflation Reduction Act of 2022 (IRA), provides for up to an additional 10% tax credit for certain qualified facilities or energy projects (together, Applicable Projects) otherwise qualifying for the Sections 45 and 45Y production tax credit (PTC) or the Section 48 and 48E investment tax credit that meet certain domestic content requirements.

This alert highlights the six biggest takeaways from this guidance.

- The guidance provides critical definitions for previously undefined terms, including Applicable Project Component (APC).

- A manufactured product that includes components not actually manufactured in the United States may still be deemed to be manufactured in the United States if a certain percentage of all manufactured product APCs for an Applicable Project are US-based costs.

- The domestic content requirements do not apply to subcomponents.

- Certain project components for utility-scale solar photovoltaic (PV) systems, on- and off-shore wind facilities, and battery energy storage technology are automatically classified as a steel or iron APC or a manufactured product APC.

- The domestic content requirements do not apply to used property on retrofitted projects if the fair market value of the used property is less than 20% of the Applicable Project’s total value.

- While this notice provides some much-needed clarification for some requirements, it generates more questions about others.

Domestic Content Bonus Credit Requirement Generally

To qualify for the credit, a taxpayer must certify to the Secretary of the Treasury that any steel, iron, or manufactured product that is a component of an Applicable Project was produced in the United States by meeting the domestic content requirements described below. Applicable Projects are eligible for a 2% to 10% bonus credit depending on whether the Applicable Project also satisfies (or is deemed to satisfy) certain wage and apprenticeship requirements. Generally, to meet the domestic content requirements, the following must be satisfied:

- For products that are primarily iron or steel and structural in function, 100% of the steel and iron must be manufactured in the United States (Steel or Iron Requirement).

- For manufactured products, the product must be manufactured in the United States and initially at least 40% of all APCs must also be manufactured in the United States. The domestic content percentage increases to 55% if construction begins in 2026 or thereafter (Manufactured Product Requirement).1

The domestic content requirements are to be interpreted consistent with the Federal Transit Authority’s “Buy America” requirements under 49 CFR Section 661.

Critical Terms are Now Defined

Notice 2023-38 provides definitions for the following previously undefined terms,2 including the following critical definitions:

Applicable Project Component (APC)

Any article, material, or supply, whether manufactured or unmanufactured, that is directly incorporated into an Applicable Project.3 An APC may qualify as steel, iron, or a Manufactured Product.4

Manufactured Product

An item produced as a result of the manufacturing process.5

Manufactured Product Component

Any article, material, or supply, whether manufactured or unmanufactured, that is directly incorporated into an APC that is a Manufactured Product.6

Manufacturing Process

The application of processes to alter the form or function of materials or of elements of a product in a manner adding value and transforming those materials or elements so that they represent a new item functionally different from that which would result from mere assembly of the elements or materials.7

Non-US Manufactured Products Can Still Be Deemed Manufactured in the United States

Generally, the Manufactured Products Requirement is met if all APCs that are Manufactured Products are produced in the United States.8 A Manufactured Product is produced in the United States (a “US Manufacturing Product”) if:

- All of the manufacturing processes for the Manufactured Product take place in the United States; and

- All of the Manufactured Product Components of the Manufactured Product are manufactured in the United States (regardless of whether its subcomponents are manufactured in the United States).9

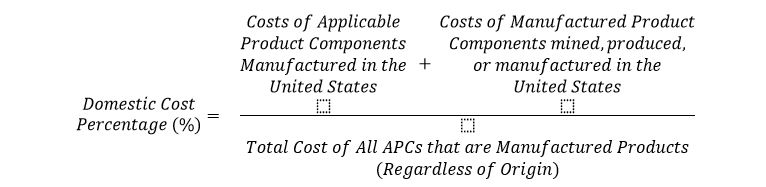

However, a Manufactured Product in an Applicable Project can be deemed to be produced in the United States if the domestic costs associated with the manufacturing process of all Manufactured Product APCs for that Applicable Project (the Domestic Cost Percentage) is greater than or equal to the required domestic content percentage that applies to that Applicable Project. Notice 2023-38 provides that the Domestic Cost Percentage is determined by dividing the cost of domestic manufactured products and components—which itself is the sum of domestically manufactured APCs and domestically produced Manufactured Product Components—by the total cost of all APCs that are manufactured products (regardless of origin). Such costs include production costs for US Manufactured Products and acquisition costs of domestically produced US Manufactured Product Components, but do not include production costs for non-US Manufactured Products and costs to incorporate APCs in the Applicable Project. In summary:

Costs include:

|

Costs do not include:

|

Domestic Content Requirements Do Not Apply to Subcomponents

Notice 2023-38 makes clear that the domestic content requirements are not concerned with subcomponents, which eases the burden of taxpayers trying to determine if they qualify for the bonus credit. For instance, the Steel or Iron Requirement does not apply to steel or iron used in subcomponents of Manufactured Product Components, which includes without limitation nuts, bolts, screws, or similar items that are made primarily of steel or iron but are not structural in function.10 Similarly, whether a Manufactured Product is produced in the United States is determined based only on the location of the manufacturing processes for the Manufactured Product and the Manufactured Product Components, and not for any subcomponents.

Automatic Classification of Certain Project Components

Treasury and the IRS identified in Notice 2023-38 certain APCs that are found in utility-scale solar PV systems, on- and off-shore wind facilities, and battery energy storage technologies.11 These APCs are automatically categorized as a steel or iron APC or a manufactured product APC.12

Notice 2023-38 refers to this as a “safe harbor”; however, this name may be somewhat misleading, as these APCs still must meet the domestic content percentage thresholds outlined above.

Special Rule for Retrofitted Projects

Notice 2023-38 provides that an Applicable Project may qualify as originally placed in service even though it contains some used property, provided that the fair market value of the used property is less than 20% of the Applicable Project’s total value (80/20 Rule). In other words, 80% or more of the Applicable Project’s value must be new property.13

If the Applicable Project meets the 80/20 Rule, it is eligible for the domestic content bonus credit if the new property meets the domestic content requirements outlined above.14

Further Guidance Needed

While Notice 2023-38 answers some questions about the IRA’s domestic content requirements, it also leaves some unanswered—and in fact raises even more uncertainty in some areas. For instance, the notice provides that the Steel or Iron Requirement applies to APCs that are (1) construction materials made “primarily” of steel or iron and (2) are “structural” in function. But the notice fails to define either “primarily” or “structural,” thus undercutting the clarification that the guidance was supposed to provide to taxpayers.

Additionally, as noted above, the guidance defines “manufacturing process” as the “application of processes to alter the form or function of materials or of elements of a product in a manner adding value and transforming those materials or elements so that they represent a new item functionally different from that which would result from mere assembly of the elements or materials.” But this definition provides no real guidance as to what separates a “manufacturing process” from “mere assembly,” and the rest of the notice provides none either.

Unless Treasury and the IRS clarify these uncertainties, taxpayers will be left trying to read between the lines to figure out if they qualify for the credit.

Conclusion

Notice 2023-38 provides long-awaited and much needed guidance for taxpayers seeking to capitalize on the IRA’s bonus credits for renewable energy projects. However, these guidelines are not yet finalized as rules. Treasury intends to issue proposed regulations regarding these requirements, which will apply to taxable years beginning after 12 May 2023. Until those regulations are proposed, taxpayers can rely on Notice 2023-29 for the domestic content requirements for projects that begin construction before 90 days after the date that the proposed regulations are published in the Federal Register.

We encourage interested parties to file public comments with Treasury and the IRS to raise any issues or proposed changes to these forthcoming regulations. K&L Gates lawyers are available to assist with drafting such public comments and with any other questions regarding this guidance.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.