Manufacturing Technologies

New privacy regulations along with new sets of guidelines in relation to the principle of “privacy by design” require thorough implementation in a company’s terms and conditions, reporting, and elsewhere. A secure communication management framework, such as the e-ID concept, is needed to comply with EU regulatory requirements, for example.

As automation propels big data, we help our clients develop effective solutions for protecting and managing information assets and complying with data protection law, including the preparation of expert opinions regarding data protection issues, drafting data protection guidelines, assisting with the appointment of data protection supervisors, and settling data protection issues in connection with compliance investigations.

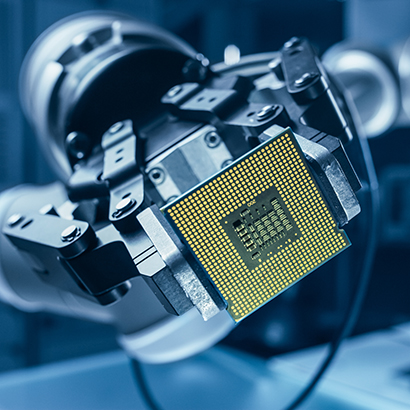

Cyber threats are a growing concern for manufacturers of all sizes. Most manufacturers are critical infrastructure organizations with automated processes, intellectual property, and other sensitive information that may be vulnerable to cyber attacks. We help manufacturers prevent and deter attacks, pursue perpetrators, and mitigate risk and loss. Our team includes members with extensive experience in public policy, cyberforensic investigations, Internet tracking, rapid response, and insurance coverage.

Thought Leadership

The year 2025 saw significant regulatory activity in the realm of digital assets. The US Congress and financial regulators took steps to create and implement a clear legal framework to facilitate financial transactions using digital assets, and they will continue to do so in 2026.

New York state and New York City continue to advance an extensive and evolving framework of workplace regulations.

On 20 February 2026, the US Supreme Court issued its decision in Learning Resources, Inc. v. Trump, consolidated with Trump v. V.O.S. Selections, Inc., addressing whether the President has authority under the International Emergency Economic Powers Act to impose tariffs.

In this article, Dr. Jan Boeing and Arnaud Dobelle outline the key milestones of the new regulatory framework, its interplay with financial sector rules such as DORA and PSD2, and what the upcoming Digital Omnibus proposal means for organisations deploying AI in Europe.