Election 2020: State of Play and What it Means for 2021

Updated: 11 November, 12:00 P.M. ET

On 7 November 2020, following several days of uncertainty while ballots were being counted in several states, former Vice President Joe Biden was projected to be the 46th President of the United States. Although the projection from most news organizations provides some certainty, it is important to note that President Trump has not conceded the race as of this writing. President Trump’s campaign is expected to continue to pursue avenues such as ballot recounts in states with narrow margins and legal challenges, though it is unclear whether such efforts will be so significant as to change the outcome of the election.

At the time of this writing, a number of races remain uncalled in the House and Senate. In the House, Democrats will maintain control, though with a slimmer majority. There is less certainty in the Senate, where two races remain uncalled, and two more will not be decided until after January runoff elections.

Looking ahead, there are several significant implications from a policy perspective for the Lame Duck Session of Congress, 2021, and beyond. Below is the latest state of play.

election outcome

Presidential Election

The next president of the United State is projected to be former Vice President Joe Biden. While the results are based on projections, in terms of next steps in the process, the certification process will take place, depending on the state, between 10 November and 8 December. The Electoral College meets on 14 December to officially vote for the next president. Congress is scheduled to meet on 6 January 2021 to certify the results, though that date can potentially be changed. Inauguration Day is 20 January 2021.

The Biden campaign launched its transition team’s website on Thursday, 5 November. We anticipate the website will start to fill out with policy plans and possibly announcements of cabinet choices in the coming weeks.

Senate

It is unknown who will control the Senate. Of the races that have been called, the current split is 48-48. Democrats flipped two seats, while Republicans picked up one seat. In Arizona, Democrat Mark Kelly beat incumbent Republican Martha McSally. In Colorado, Democratic former Governor John Hickenlooper defeated incumbent Republican Cory Gardner. In Alabama, Republican Tommy Tuberville unseated incumbent Doug Jones.

Four seats remain outstanding. Two races that remain tight and appear to be favoring Republican incumbents include Sen. Thom Tillis in North Carolina, and Sen. Dan Sullivan in Alaska. Two races in Georgia, a special election in Georgia for the seat currently held by Republican Sen. Kelly Loeffler, and the regularly scheduled election for the seat currently held by Republican Sen. David Perdue, will go to runoffs scheduled for 5 January 2021. If the tight margins hold in the chamber, control could remain unknown until after the runoffs. It remains a possibility that the Senate could result in a 50-50 party split and would tip Democratic as Vice President-elect Kamala Harris has the authority to cast tiebreaking votes.

House

The Democrats are projected to maintain control of the House, though their margin has narrowed. Current projections show Republicans gained at least eight seats while Democrats gained only three. While Democrats projected confidence going into Election Day that they would expand upon their majority, five of the eight seats Democrats lost are freshmen in districts that carried them to power in 2018. Two seats they picked up so far are in newly redistricted North Carolina where the new lines heavily favor Democrats. 21 races remain uncalled.

Congressional and Committee Leadership

Leadership

Party leadership in both chambers is expected to remain relatively stable. In the Senate, Majority Leader Mitch McConnell (R-KY) easily won reelection and is not currently facing any challenges to his leadership position. Other Republicans in Senate leadership that appeared vulnerable but easily won include Conference Vice Chairman Joni Ernst of Iowa and Counsel to the Majority Leader John Cornyn of Texas. Democrats had no major races against their party leaders, and Minority Leader Chuck Schumer of New York is expected to remain as head of the caucus.

On the House side, there are no major challenges to Speaker Nancy Pelosi (D-CA), Majority Leader Steny Hoyer (D-MD), or Majority Whip Jim Clyburn (D-SC) so far. There will be an open race for Assistant Speaker, as Rep. Ben Ray Luján (D-NM) was elected to the Senate. There is also an open race for Vice Chair of the Democratic Caucus, as Rep. Katherine Clark of Massachusetts runs for Assistant Speaker. Rep. Cheri Bustos (D-IL) announced she will not seek another term leading the Democrat’s campaign arm. Potential members to replace Rep. Bustos include Tony Cardenas of California, Sean Patrick Maloney of New York, Linda Sanchez of California, and Marc Veasey of Texas. Rep. Joyce Beatty (D-OH) has announced her intention to run for chair of the Congressional Black Caucus. Leadership elections for Democrats will be held on 18 to November.

There are no major challenges expected for Republican leadership in the House. Leader Kevin McCarthy (R-CA) is expected to stay in his current role, as is Minority Whip Steve Scalise (R-LA). Leadership elections for the GOP will be held on 17 November.

Committees

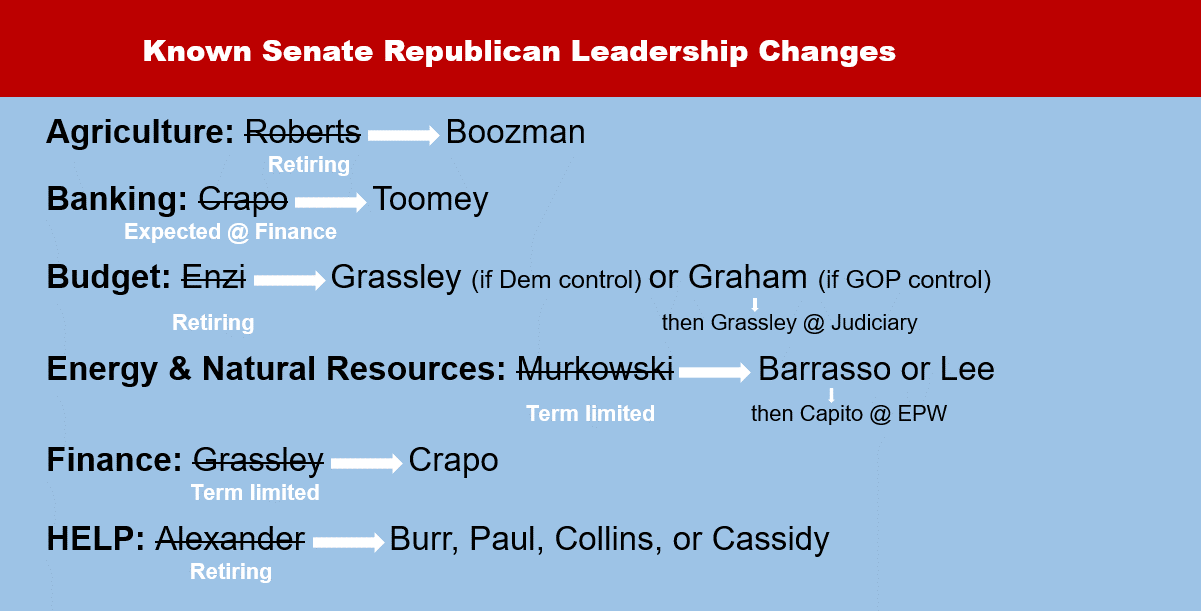

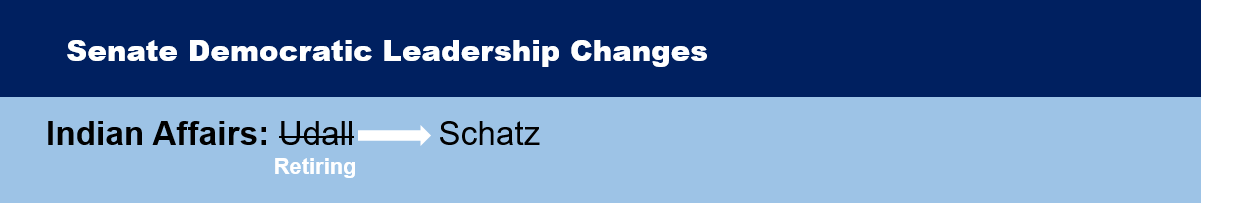

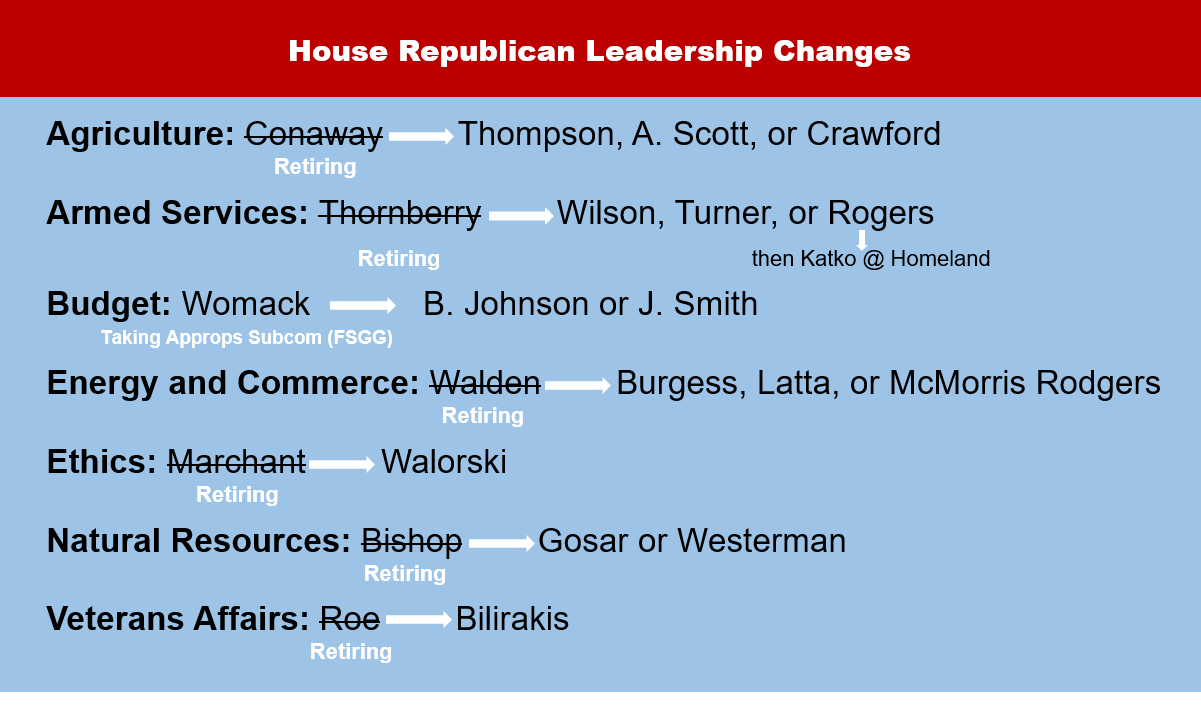

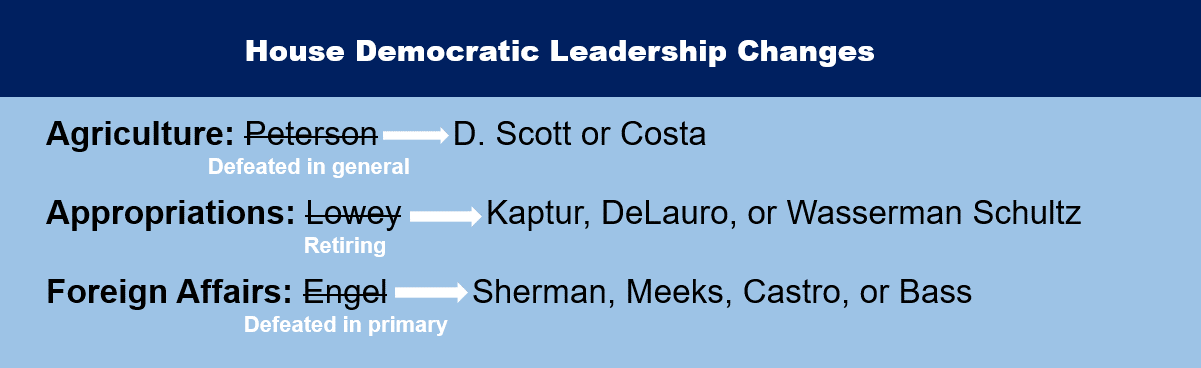

A new Congress usually brings about changes to the top leadership slots of committees. The 117th Congress will be no different as a number of committee leaders in both the House and Senate are retiring or lost re-election. Republicans in both chambers also place term limits on how long a member may serve as both chairman and ranking member of a committee. Here is what we know so far regarding leadership changes at the committee level:

In the Senate, a number of additional committee leadership changes are expected on the Republican side, but will be determined by control of the chamber. Because of the conference’s rules, Sen. Lisa Murkowski (R-AK) is term limited and will have to step down as the top Republican on the Energy and Natural Resources Committee. However, in the case of the Homeland Security and Government Affairs Committee, Sen. Ron Johnson (R-WI) will have to step aside if Republicans maintain control of the Senate, but could stay on as ranking member. The same holds for Sen. Roy Blunt (R-MO) at the Rules and Administration Committee. If the Democrats are in control, Sen. Murkowski may assert her seniority at the Indian Affairs Committee to take the ranking member slot. Sen. Chuck Grassley (R-IA) is term limited as the top Republican at Senate Finance. If Republicans maintain control, he is expected to become chairman of the Judiciary Committee. However, if Democrats take control, he is instead expected to take the top Republican slot at the Budget Committee.

There remains an additional unknown with respect to the potential leadership of the Senate Select Committee on Intelligence and the Small Business and Entrepreneurship Committee. Sen. Richard Burr (R-NC) stepped down from leading the Intelligence Committee as a result of an ongoing investigation. Sen. Marco Rubio (R-FL) received a waiver to lead both committees in the interim. We could see additional changes to the leadership of those committees or a restoration of Sen. Burr’s seat. There has also been some speculation that Sen. Burr could become chair of the Health, Education, Labor and Pensions Committee.

What Are the Implications for the Lame Duck?

There are several pending policy issues for consideration ahead of the adjournment of the 116th Congress, including ongoing debates regarding the possibility of a COVID-19 relief package and the continued funding of government. That said, there continue to be open questions regarding bandwidth and appetite to address pending items during the Lame Duck.

FY2021 Appropriations

One of the key issues that must be addressed during the Lame Duck is the continuation of government funding, which currently expires on 11 December 2020. In addition to the funding of government, flexibilities related to certain 2019 novel coronavirus (COVID-19) pandemic measures, authorization of the Temporary Assistance for Needy Families (TANF) and related programs, and several Medicare and Medicaid-related measures (known as health care extenders) expire on 11 December; several temporary tax policies, known as tax extenders, are also slated to expire on 31 December 2020.

At this juncture, a range of approaches is possible. There may be some impetus to address government funding and several of the other pending programs and policies slated for expiration, as a way to clear the decks for 2021. Other possible approaches may be a shorter-term continuing resolution extension into early 2021 and/or retroactively addressing policies such as tax and health care extenders. Although not likely, in the case an agreement is not reached, it is possible there may be a government shutdown.

COVID-19 Relief

The outlook for a COVID-19 relief package following the election is unclear. There is a relatively short window for Congress to consider and pass a COVID-19 relief package before the end of the year. However, the need to address the continuation of government funding creates a complex dynamic. On the one hand, it decreases bandwidth for negotiations on COVID-19 relief; on the other hand, it could provide a must-pass vehicle for relief to ride on. Ahead of the election, Speaker Pelosi and Treasury Secretary Steven Mnuchin were engaged in long-term negotiations and indicated some interest in attempting to pass a COVID-19 relief package before the end of the year. Notably, Leader McConnell has indicated an interest in re-engaging in COVID-19 relief negotiations, though advocated for a more targeted relief package. Speaker Pelosi has also expressed interest in resuming negotiations, though in response to Leader McConnell said that she continues to focus on a comprehensive relief package. Based on these positions, however, it remains unclear whether there is sufficient flexibility among the parties on the size and scope of the possible package to achieve an agreement. If COVID-19 relief is not addressed by year-end, negotiations are likely to be renewed in early 2021, as such a package is a top priority of President-elect Biden. The details will depend on the intersection of the ongoing health and economic impact of COVID-19 at that point in time – including the prospects for a vaccine – and the interplay between who is in the White House and the constitution of the Senate.

FY2021 National Defense Authorization Act (NDAA)

Congress is currently on track to wrap up the annual defense reauthorization bill before the end of the year. House and Senate conferees have been working through their differences, and we anticipate the legislation could be finalized as soon as the end of November.

Another area of focus in the Lame Duck will be on executive activity. The Trump Administration will continue its focus on finalizing key rulemakings before Inauguration Day. We also anticipate a focus in the Senate on nominations and confirmations of judicial appointees.

What Can We Expect in 2021?

We anticipate a significant amount of legislative and regulatory activity, even if it does not advance to enactment, at the outset of 2021, creating risks and opportunities for a range of stakeholders.

In many ways, the agenda is set. Not only will there be a strong focus on COVID-19 relief, oversight, and post-pandemic policy, activity is expected on a range of issues, including technology, transportation/infrastructure, labor/workforce, health care, tax, energy and the environment, sustainability, financial services, trade, international affairs, and social/racial injustice issues. The direction of policy, however, will be governed by the interplay between the White House and Congress.

Our previous alert, Trump v. Biden: What Might the Next Four Years Look Like?, provides an overview of the major priorities that the next administration may want to pursue. It will be critical for stakeholders to remain engaged as policies are shaped.

What Additional Dynamics Will Shape Policy?

There are several other political and procedural dynamics that will be critical in shaping the policy environment as we look ahead to 2021 and beyond, regardless of the outcome of the election.

Expedited Procedures for Consideration?

If Democrats gain at least 50 votes in the Senate, it is possible that Democrats could use the budget reconciliation process to advance their agenda. This process requires only a majority vote in the Senate, which Democrats could have including the vote of Vice President-elect Harris. Congress is allowed three budget reconciliation bills per year, for revenue, spending, and the debt; these can be separate or combined. The Senate’s “Byrd Rules” impose restrictions limiting what can be included in a reconciliation bill, including that a measure must have more than an incidental budgetary impact and cannot add to the deficit outside the ten-year budget window. However, the Affordable Care Act and the Tax Cuts and Jobs Act both were passed using budget reconciliation, so it would be a powerful tool accessible to Democrats to enact their policy priorities. Notably, the narrower Democratic majority in the House could impact the viability of the budget reconciliation process. House Democrats would need to carefully thread the needle to develop a budget resolution that appeals to enough Democrats, both moderates and progressives, to make this a viable path forward. Setting aside the filibuster would be an alternative approach to the 51 vote threshold and would avoid the limitations of the Byrd Rule.

The Power of the Executive

Recent administrations have continued to test the limits of presidential power. In this regard, the Trump Administration engaged heavily in foreign affairs priorities and aggressively used the powers of appointment, with a particular focus on judicial appointments given the Republican majority in the Senate. Both the Trump and Obama Administrations also focused heavily on policymaking through the rulemaking process, particularly when faced with mixed control of Congress. In a variety of areas, this resulted in significant uncertainty as different administrations dramatically shifted regulations under a broad-based statutory framework. We expect there to continue to be an aggressive push of executive power during the Biden Administration.

The Fight for the Future of the Parties

Although the 2020 election is now behind them, both parties are at an inflection point with intra-party and inter-generational questions bubbling. On the Democratic side, the debate between the moderates and progressives will continue. One the one hand, there have been some losses among moderate House Democrats, which could have the effect of bringing the party to the middle to protect other House Democrats; at the same time, there is an increased concentration among progressives. Additionally, the race for the next generation of leaders is starting in earnest. On the Republican side, President Trump has significantly shifted the intra-party dynamic, raising questions about the future positioning of the party, as well as who will ascend as leaders of the party.

At the Same Time, 2022 is Around the Corner

Although the election has just ended, the 2022 mid-term election is around the corner. In the Senate, there are a number of Republican seats in increasingly swing states that will be up, including several where members have already indicated they will be retiring. Depending on the party of the president, this could have significant implications in terms of the dynamics on deal-making. House Republicans’ priorities will also loom large as they look to follow historic trends of the opposition party winning control of Congress in the mid-terms.

Patchwork of State and Local Policy

Progressive and conservative state and local jurisdictions are likely to continue to move forward with policymaking on a range of issues – from labor and workforce, to health, data privacy, and beyond – in light of the complexity of Congress attempting to move forward with preemptive federal laws. National and regional companies and organizations will likely have to continue navigating the patchwork of laws and regulations absent federal preemptive action.

International Uncertainty

The EU, or potentially individual EU nation-states, are expected to continue to advance policy priorities related to data, technology, taxation, and sustainability. Additionally, uncertainty around U.S.-China relations will continue to have broad economic ramifications – particularly on questions related to technology – and will likely reverberate around the globe.

The Long Tail on the Pandemic

With nearly $3.5 trillion of COVID-19-related relief for businesses and families passed and more relief likely, there will be continued oversight and investigations over the deployment and recipients of the relief. Moreover, the pandemic has dramatically reshaped the way in which and where we work, live, and play, which may result in broad-based shifts in policy on issues such as transportation and infrastructure, workforce, technology and data, education, urban-rural policy, sustainability, health care, and social and racial injustice issues.

Media

The continued acceleration of the news cycle, particularly with the velocity of social media, and the amplification of such news by policymakers, will continue to create policy and oversight risks for companies and organizations. Proactive engagement strategies – even those that are targeted – can help to insulate such risk.

Strong Calls for Leadership

In recent years, as there has been White House and Congressional activity on a range of policies with broad stakeholder reactions, companies and organizations have increasingly found themselves being called to action to demonstrate leadership. Measured, proactive engagement may also mitigate possible risks, while creating positive opportunities for policy engagement.

This publication/newsletter is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in regard to any particular facts or circumstances without first consulting a lawyer. Any views expressed herein are those of the author(s) and not necessarily those of the law firm's clients.